Workbook User Guide

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 24/19/2024

Table of Contents

LoanBeam Overview 3

Workbook

Basic Functionality 4

Cover Page 9

Summary Sheet

FNMA SEI 1084 (Fannie Mae) 10

Form 91 (Freddie Mac) 13

Main Sheet 14

Wage Income 15

Schedule C 20

Schedule E - Rental

Fannie Mae Form 1038/1037 22

Freddie Mac Form 92 24

Manual Entry 25

Schedule E - Royalty 26

Schedule F - Farm 26

Trust 27

Partnership 28

Liquidity Analysis 32

S Corporation 33

Liquidity Analysis 37

Corporation 38

Transcript Comparison 40

Copyright&Condentiality 41

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 34/19/2024

LoanBeam Income Overview

LoanBeam dramatically reduces the time and effort a lender must spend reviewing and calculating a

loan application. Using innovative Optical Character Recognition (OCR) technology and advanced

algorithms, LoanBeam extracts data from documents, analyzes the data, and produces an Excel le

containing the borrower’s qualifying income.

Documents Scanned

LoanBeam scans and analyzes the following income documents:

• Paystubs

• Form W-2

• Forms 1040, 1040A, 1040EZ

• Schedules A, B, C, D, E, F

• Schedules 1, 2, 3, 4, 5, 6

• Form 1065 Partnership Tax Return

• Form 1120S S Corp Tax Return

• Form 1120 Corp Tax Return

• Partnership K-1 (1065)

• S Corp K-1 (1120S)

• Trust K-1 (1041)

• Form 2106 Employee Expenses

• Form 4562 Deprec & Amort

• Form 4797 Sale of Bus Property

• Form 6252 Installment Sale

• Form 8825 R/E Income

• Form 8829 Bus Use of Home

• 4506-T

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 44/19/2024

Basic Functionality

LoanBeam’s patented calculation technology scans borrower’s documents for relevant income data,

and then produces an easy-to-read Excel workbook with the borrower’s qualifying income. Investor

underwriting guidelines pre-applied to the calculations – leaving you with just a few elds to review or

update.

Before exploring the tabs of the Excel workbook, there are a few general concepts you should understand

about the book.

Tabs

LoanBeam’s Excel workbook has multiple tabs that help calculate qualifying income. Each tab represents

a discrete income stream.

Important! All income tabs appear in the workbook, regardless of whether the borrower has income from

that income stream.

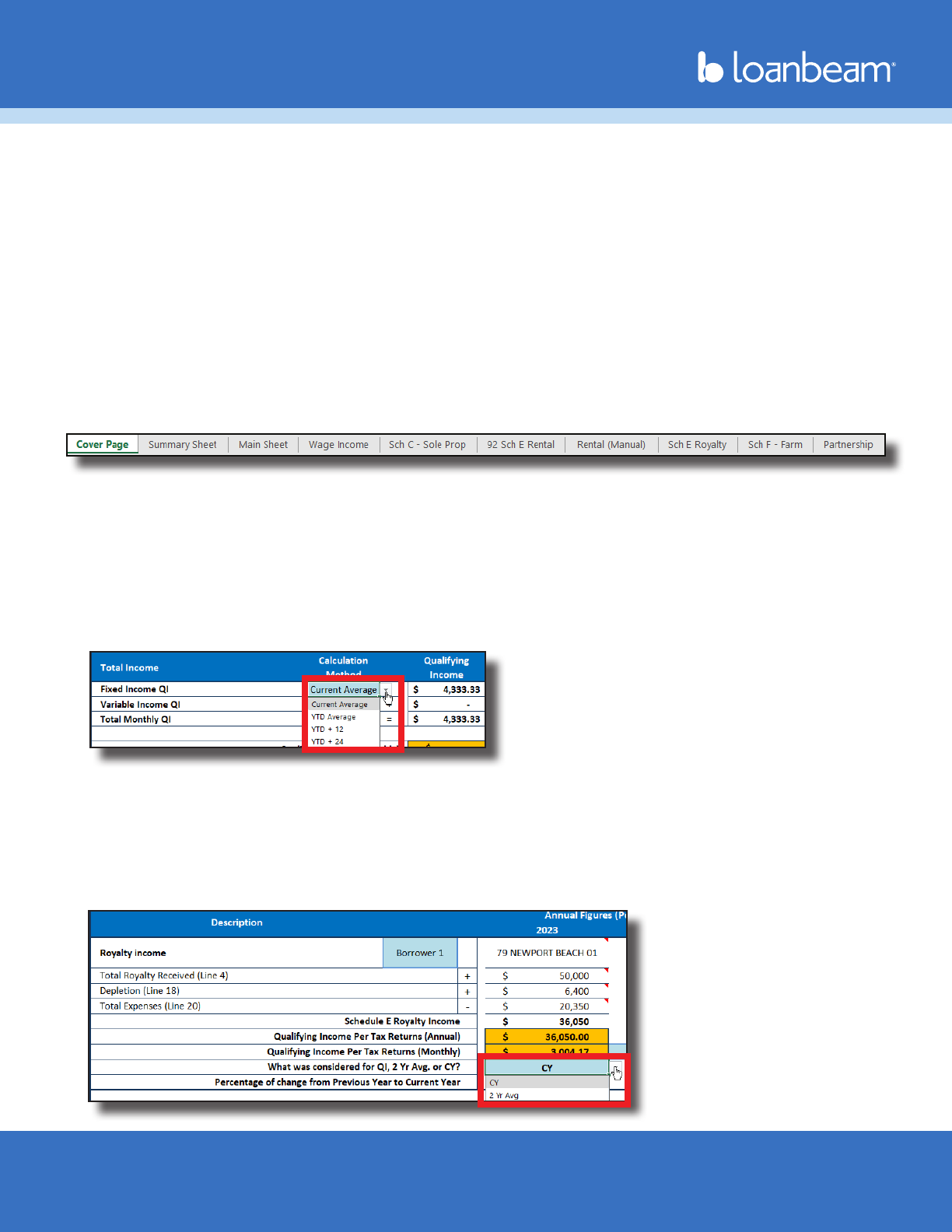

Calculation Methods

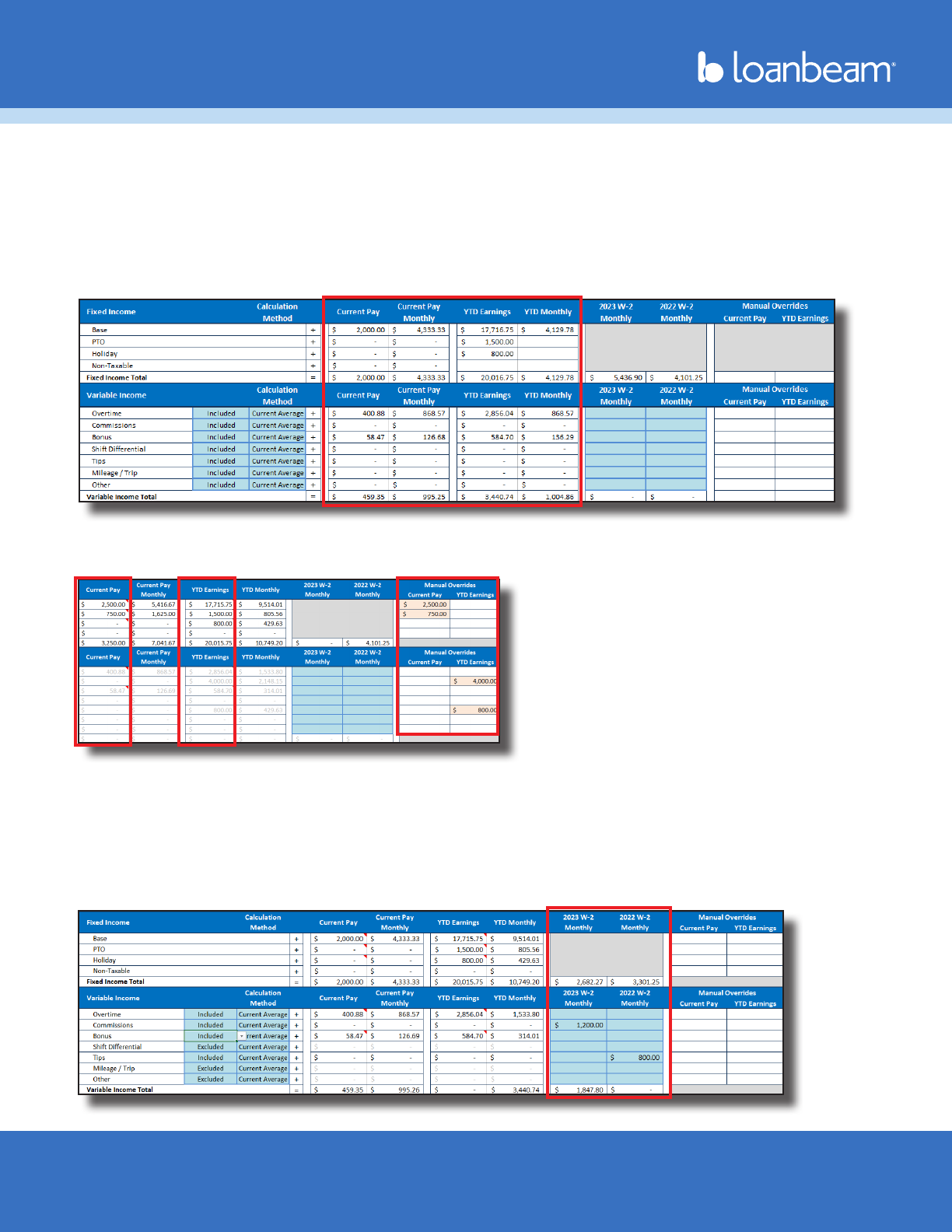

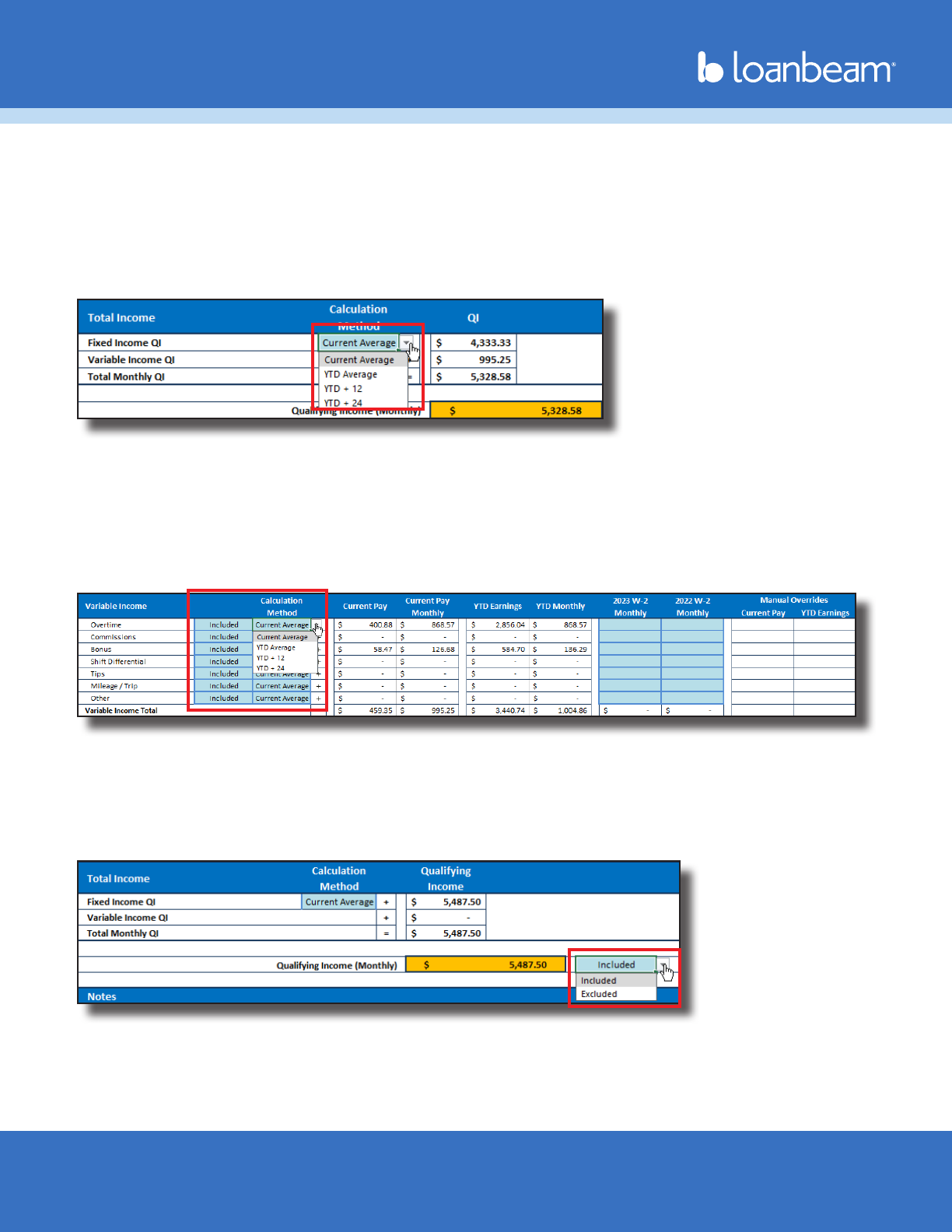

For Wage Income, the default calculation method is “Current Average,” but the calculation method may

be overridden via a drop-down eld. The four calculation method options are:

• Current Average

• YTD Average

• YTD + 12

• YTD + 24

For all other income, the workbook automatically calculates two-year (24 month) averaging based on

income trend. The workbook compares the Current Year (CY) income to Prior Year (PY), and selects the

more conservative calculation formula based on the following:

• If CY is lower than PY, LoanBeam will use CY.

• If CY is equal to or greater than PY, LoanBeam will use the 24-month average.

However, the default value can be overridden using the drop-down eld.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 54/19/2024

Basic Functionality (cont.)

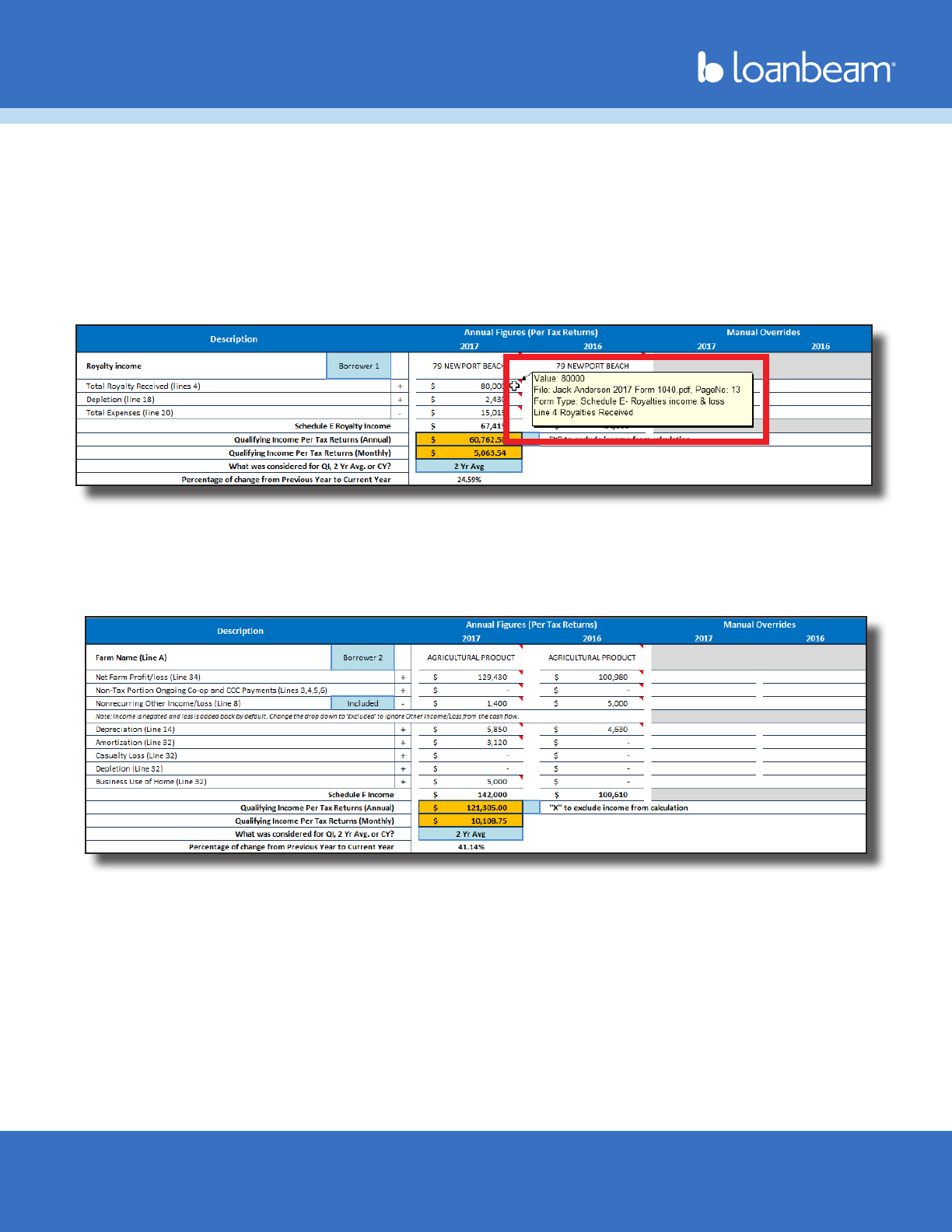

Source Document Referencing

Cells marked with a red triangle in the upper-right corner indicate that the data contained in that cell

was extracted directly from the borrower’s income documents. Hovering over these cells shows the dollar

amount, le name, and form number the income was extracted from.

Important! The note will always display the value(s) extracted from the source documentation, even if the

value in the cell was manually overridden.

Repeated Income Groups

LoanBeam’s “Repeated Income Group” functionality dynamically increases or decreases the number of

income sources of a specic type based on what was discovered in the documents. Whether there are

two businesses or two hundred, LoanBeam will evaluate them.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 64/19/2024

Basic Functionality (cont.)

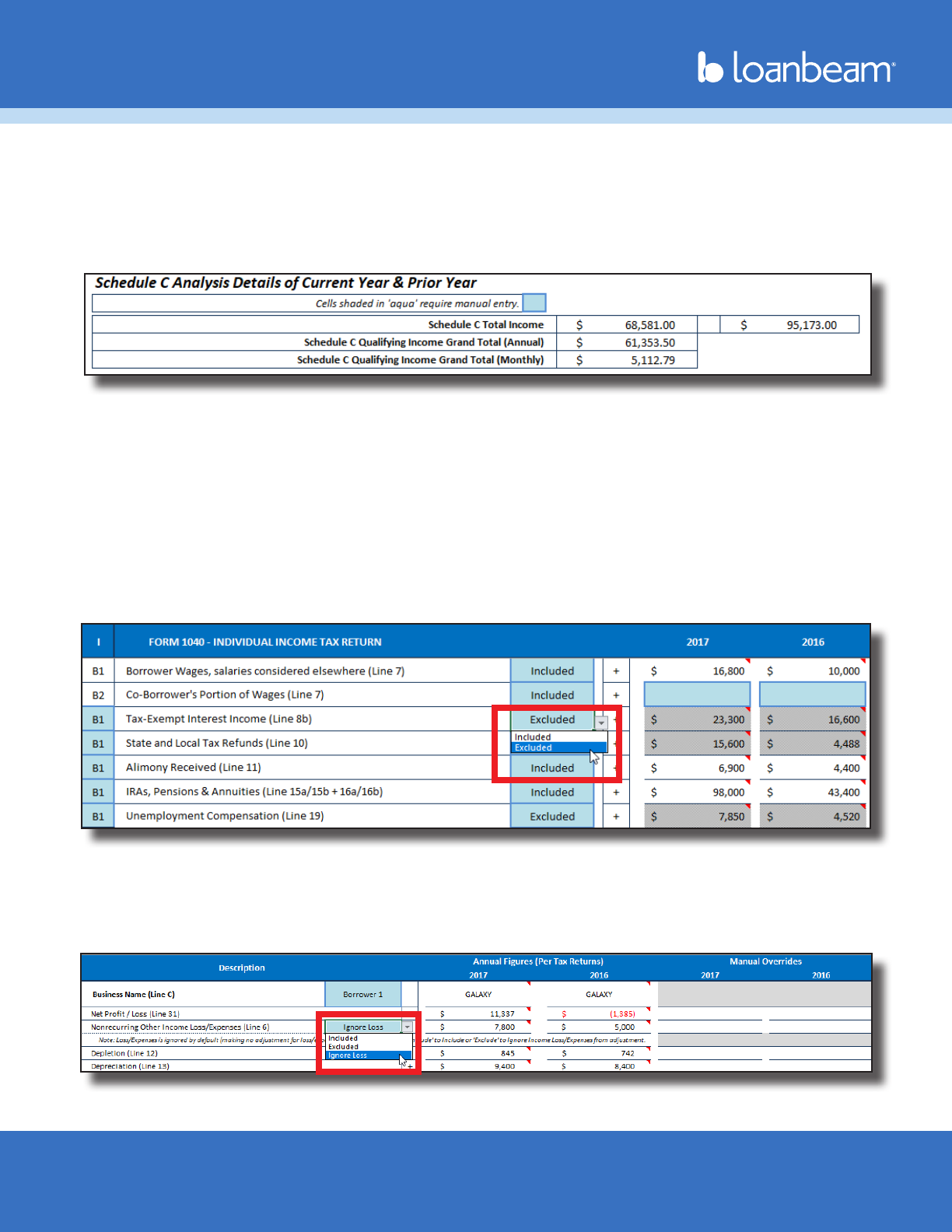

Cumulative Income Totals

The cumulative qualifying income and/or total income for all entities on each income tab is aggregated

at the top of the sheet. This amount ows to the Summary Sheet and Main Sheet.

Including and Excluding Income

When calculating qualifying income, LoanBeam includes income that is designated as “Included,” and

excludes income that is “Excluded.”

Whether an income stream defaults to included or excluded depends on each investor template’s

guidelines. Users can manually change the default designation to include or exclude income via two

methods: light blue drop-down boxes or “X to Exclude/Include” text boxes.

Drop-down

Drop-down boxes are available throughout the workbook.

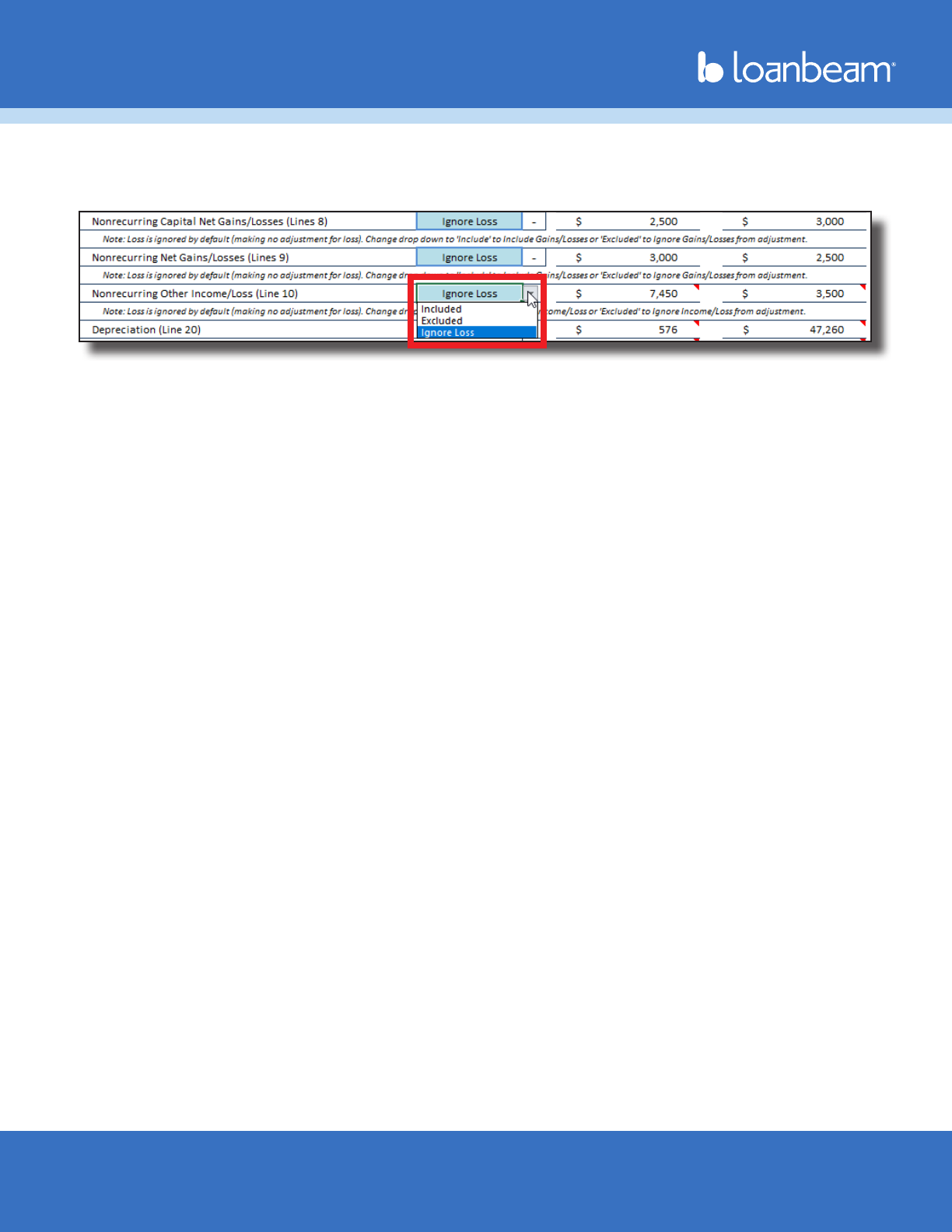

Ignore Loss

In some cases where line-item values are subtracted from income totals, there is a third drop-down option:

Ignore Loss. This is the default value where subtracting a loss from the calculations increases income. In

these cases, “Ignore Loss” leaves the income unchanged, so as to not increase income when losses occur.

As with the other drop-down boxes, the default designation can be manually overridden.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 74/19/2024

Basic Functionality (cont.)

Including and Excluding Income (cont.)

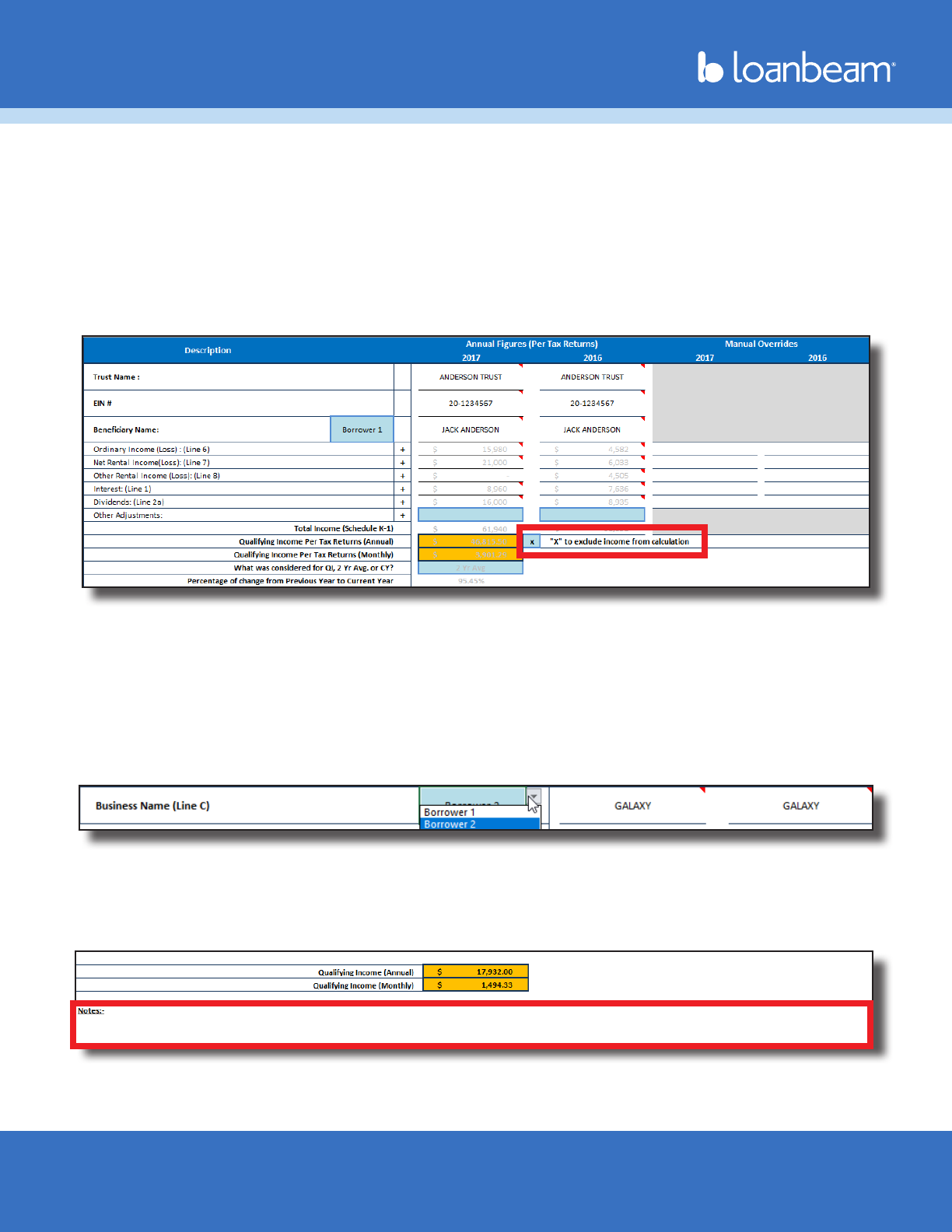

X to Exclude

To exclude a particular income source from the borrower’s qualifying income altogether, type an ‘X’ in

the “X to exclude from calculation” box. The entity’s income will turn gray, and will be excluded from the

totals at the top of the tab, as well as excluded from the borrower’s qualifying income on the Summary

Sheet and Main Sheet.

Borrower 1 vs. Borrower 2

By default, income is assigned to Borrower 1. To assign the income to Borrower 2, click the “B1” or

“Borrower 1” drop-down and select Borrower 2 to re-assign the income. This provides a convenient way to

categorize income by borrower.

Important! Assigning income to Borrower 2 does not change the cumulative qualifying income total — it

only changes who the income is assigned to.

Notes

Use the Notes section at the bottom of each “repeated income group” to comment on the reason for

manual overrides or any other changes made to the business.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 84/19/2024

Basic Functionality (cont.)

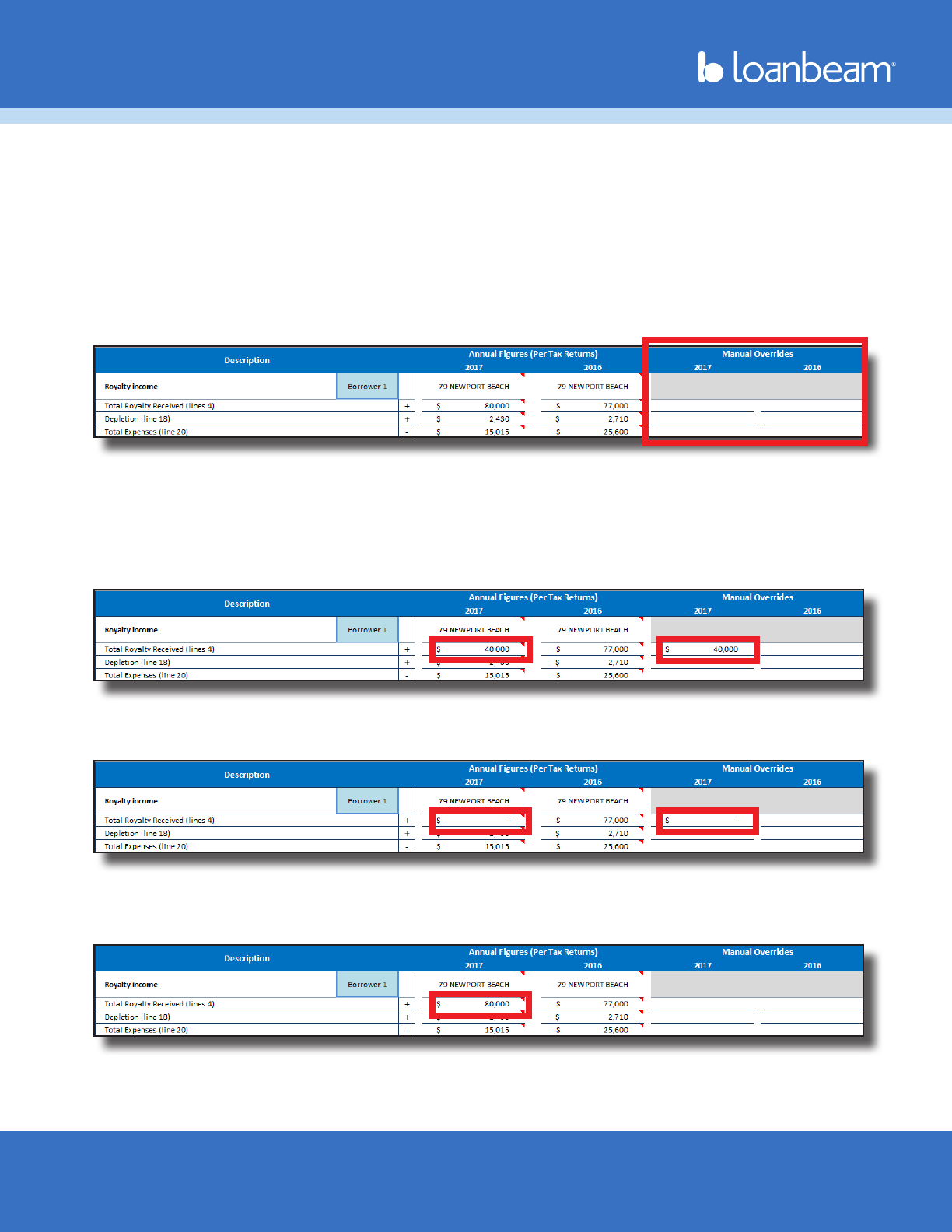

Manual Overrides

Manual override columns are provided to amend data extracted from uploaded documents. Always

remember to add documentation in the notes section when changing, removing, or adding income.

Important! Figures in the “Annual Figures (Per Tax Returns)” columns are scanned directly from the

borrower’s tax documents and are protected. They can only be altered by using the Manual Overrides

columns. In addition, line items that are the result of calculations cannot be manually changed.

The values entered in the Manual Override columns will appear in the corresponding Annual Figures

column, adjusting the Qualifying Income accordingly. There are three ways to use LoanBeam’s Manual

Override functionality.

1)Inputaspecicdollaramount.This example shows a manual override replacing the original value with

$40,000.

2) Input $0 to remove income entirely. This example shows a manual override removing the original value,

replacing it with $0.

3) Delete an override to return to the original amount. This example shows a deleted manual override,

replacing the overridden value with the original value of $80,000.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 94/19/2024

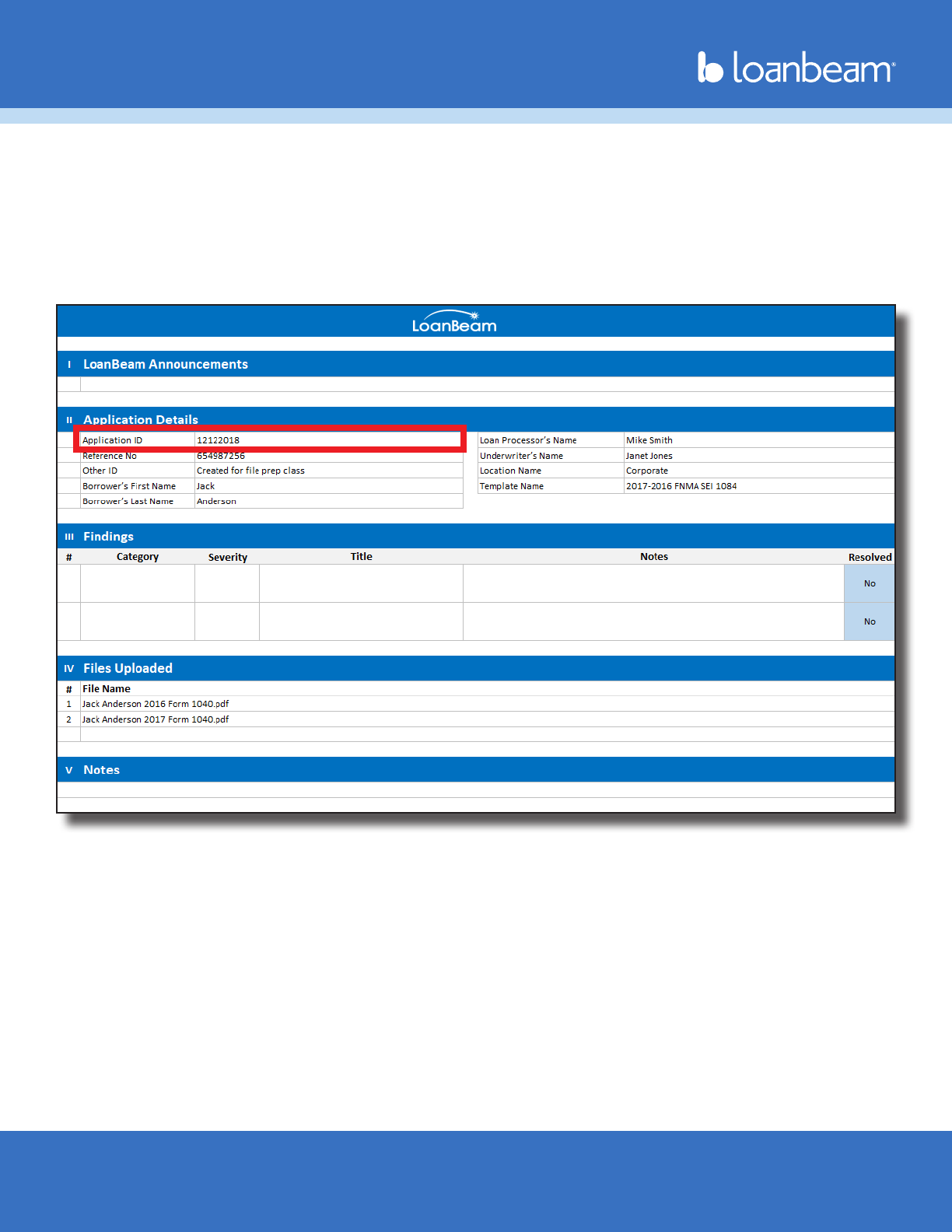

Cover Page

The rst tab in the Excel workbook is the Cover Page. This tab details borrower and loan information,

including the Application ID, Reference Number, and les uploaded. In addition, this tab displays a list

of application alerts (e.g., missing documents) dened as “Findings.” This data may be used to improve

income calculation.

Important! The number contained in LoanBeam’s “Reference No” cell may be used in Freddie Mac’s Loan

Product Advisor (LPA) to receive Rep & Warrant relief.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 104/19/2024

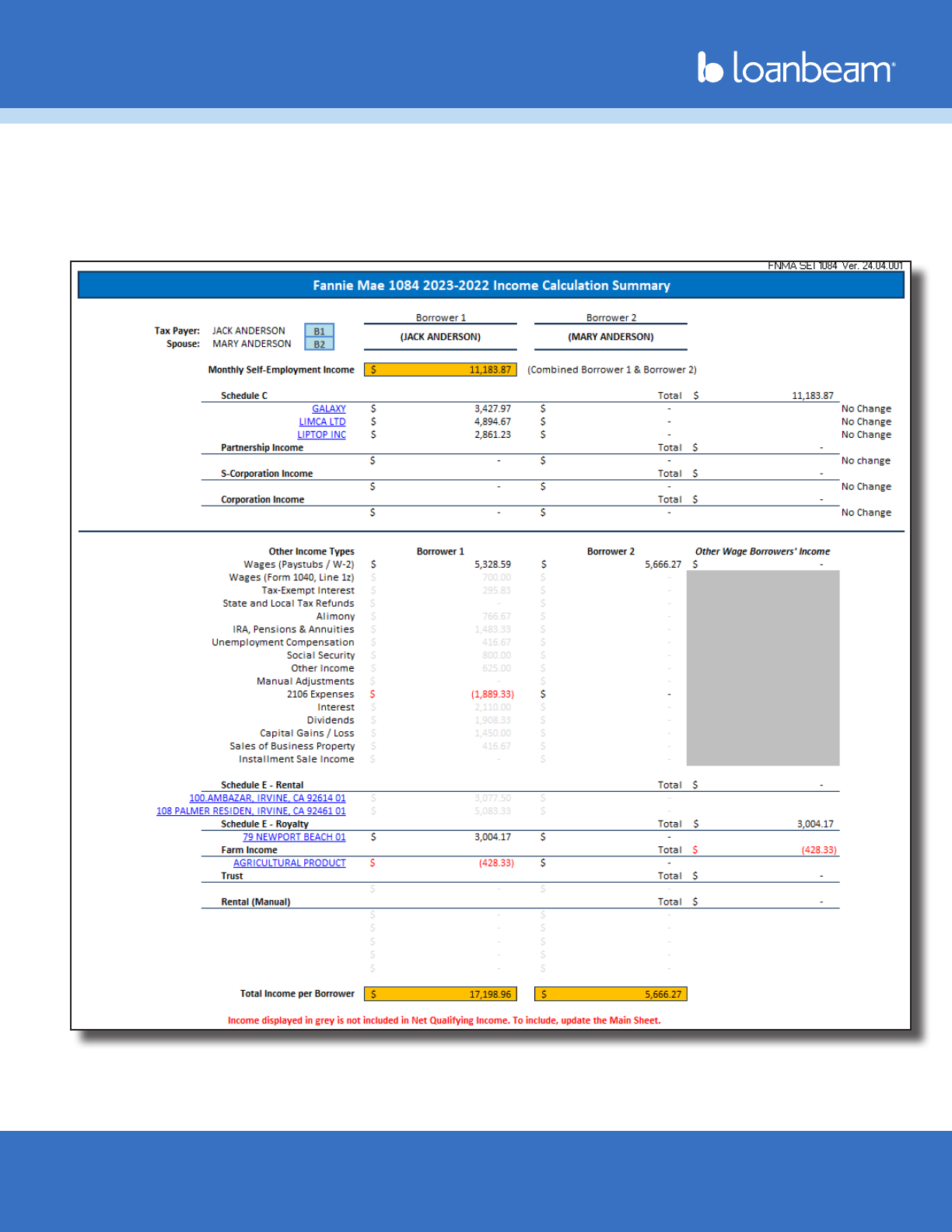

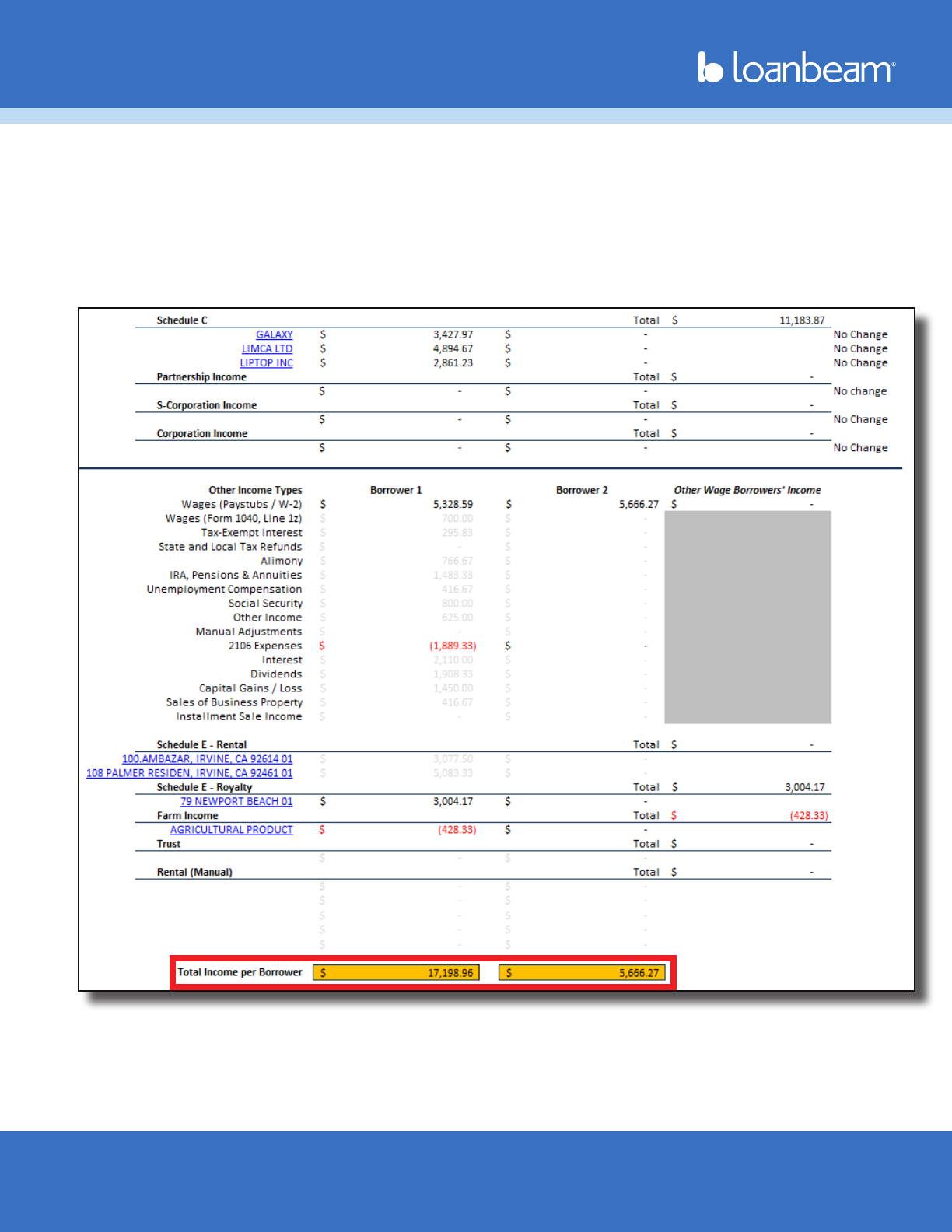

Summary Sheet (FNMA SEI 1084)

The Summary Sheet tab aggregates your borrower’s qualifying income in a single, simple-to-read location.

The borrower’s total qualifying income is a combination of the data found on the other tabs. It is important

to verify the borrower’s information on all tabs before considering the qualifying income on the Summary

Sheet as an overall total.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 114/19/2024

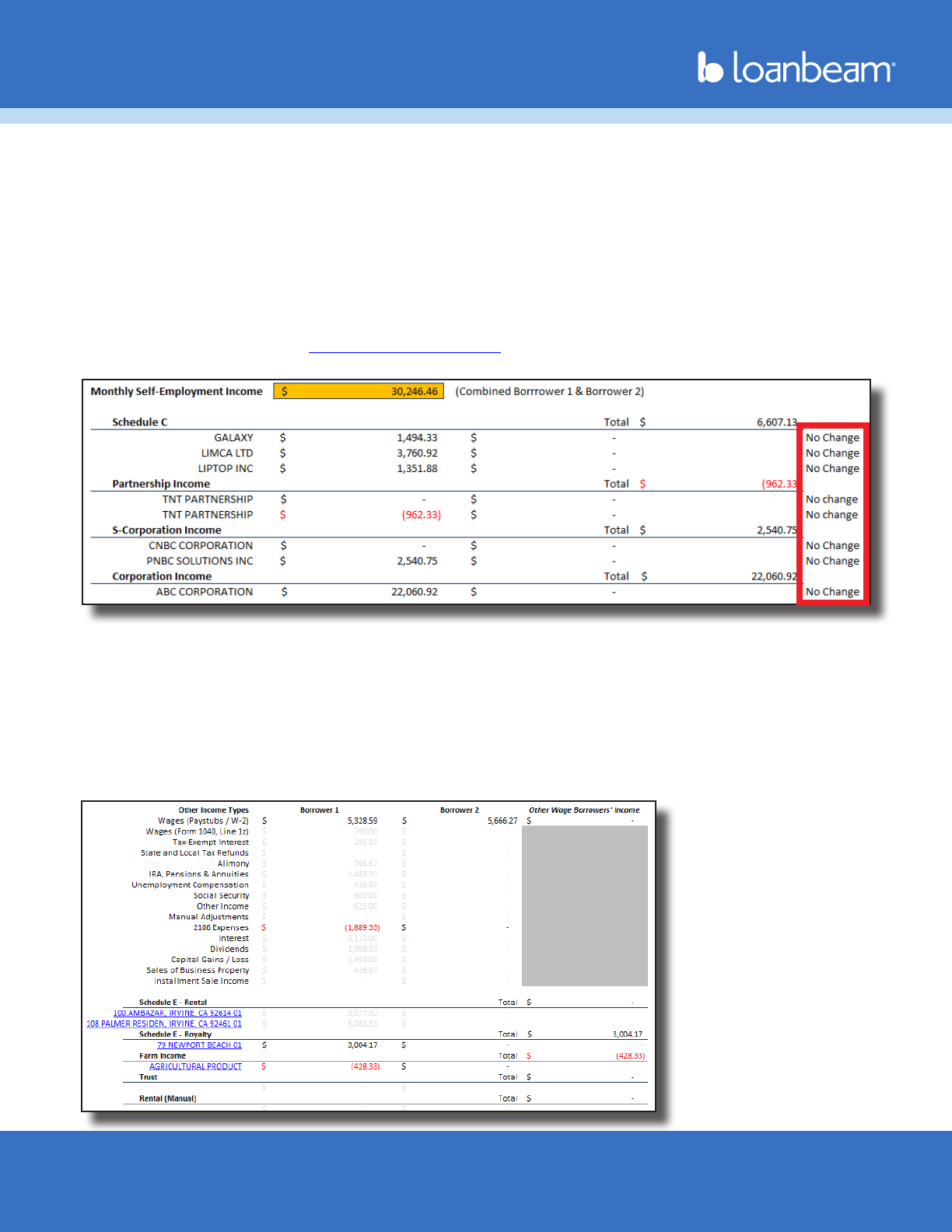

Summary Sheet (FNMA SEI 1084) (cont.)

The income found on the FNMA SEI 1084 is divided into two main sections: “Monthly Self-Employment

Income” which is the QI Fannie Mae uses for their Self-Employed Rep & Warranty program, and the

borrower’s total qualifying income.

Monthly Self-Employment Income

Displays the qualifying income totals for all self-employment income per Fannie Mae’s guidelines.

Currently, only Schedule C, Partnerships, S Corps, and C Corps are participating in the program. The

income totals for these entities may be used in Desktop Underwriter (DU) to receive Rep & Warrant relief.

Important! According to the Fannie Mae Selling Guide, the Monthly Self-Employment Income amount

calculated by LoanBeam is only eligible for Rep & Warrant if the line indicators display “No Change.”

Other Income Types

The borrower’s qualifying income from income sources other than self-employment appears in the Other

Income Types section at the bottom of the tab. This income may be used to qualify the borrower for a

loan, but is NOT included in the scope of the Fannie Mae Rep & Warrant program.

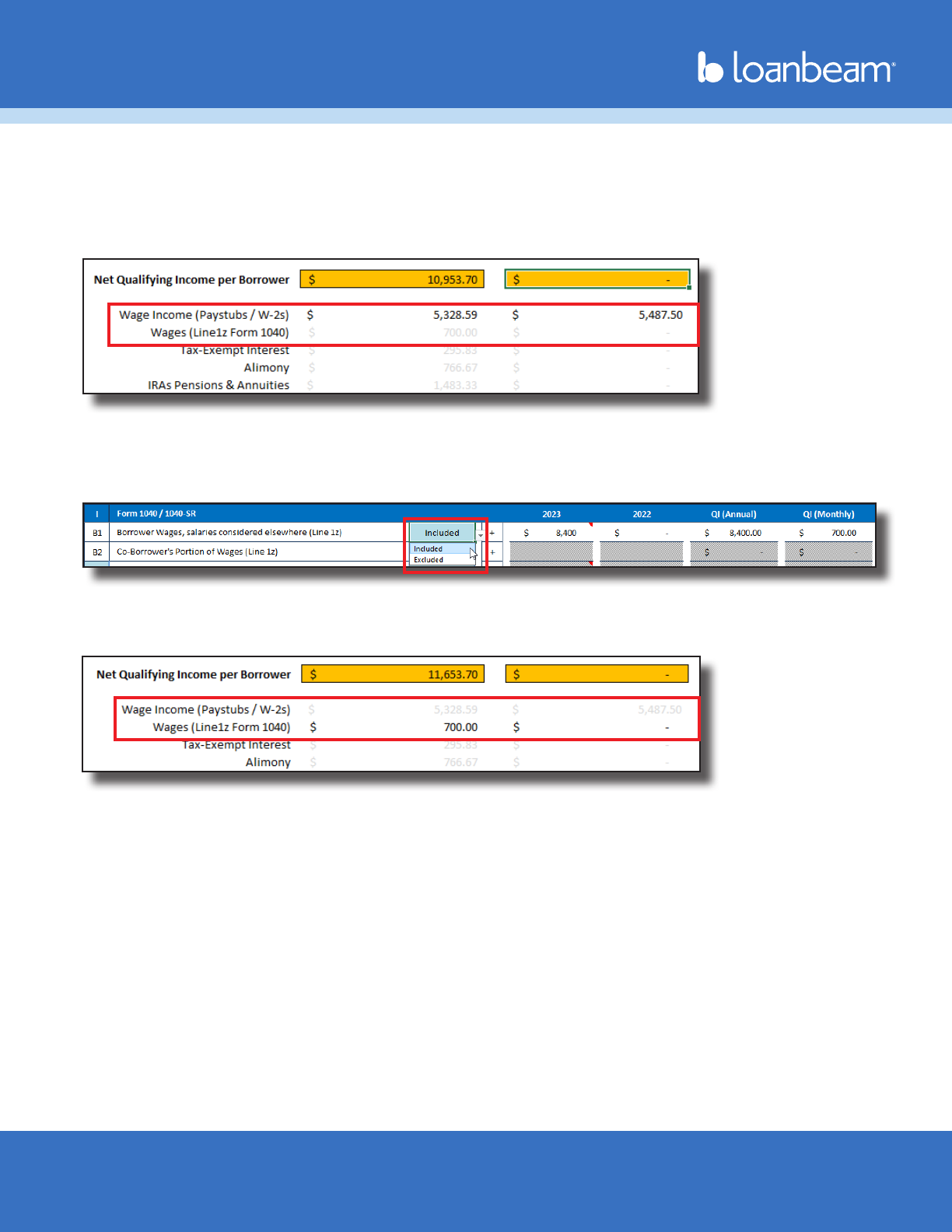

Important! Wage Income may be included from either the Wages (Paystubs/W-2) row or from the Wages

(Form 1040, Line 1z) row, but income cannot be included from both sources simultaneously. See the Wage

Income section for further information.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 124/19/2024

Summary Sheet (FNMA SEI 1084) (cont.)

Cumulative Qualifying Income

The borrower’s Monthly Self-Employment Income and Other Income Types are combined at the bottom of

the tab.

This is the monthly income the borrower qualies for per Fannie Mae’s guidelines, but is not guaranteed

under the Rep & Warrant program.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 134/19/2024

Summary Sheet (Freddie Mac Form 91)

The Summary Sheet tab aggregates your borrower’s qualifying income in a single, simple-to-read location.

The borrower’s total qualifying income is a combination of the data found on the other tabs. It is important

to verify the borrower’s information on all tabs before considering the qualifying income on the Summary

Sheet as an overall total.

Important! Wage Income may be included from either the Wages (Paystubs/W-2) row or from the Wages

(Form 1040, Line 1z) row, but income cannot be included from both sources simultaneously. See the Wage

Income section for further information.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 144/19/2024

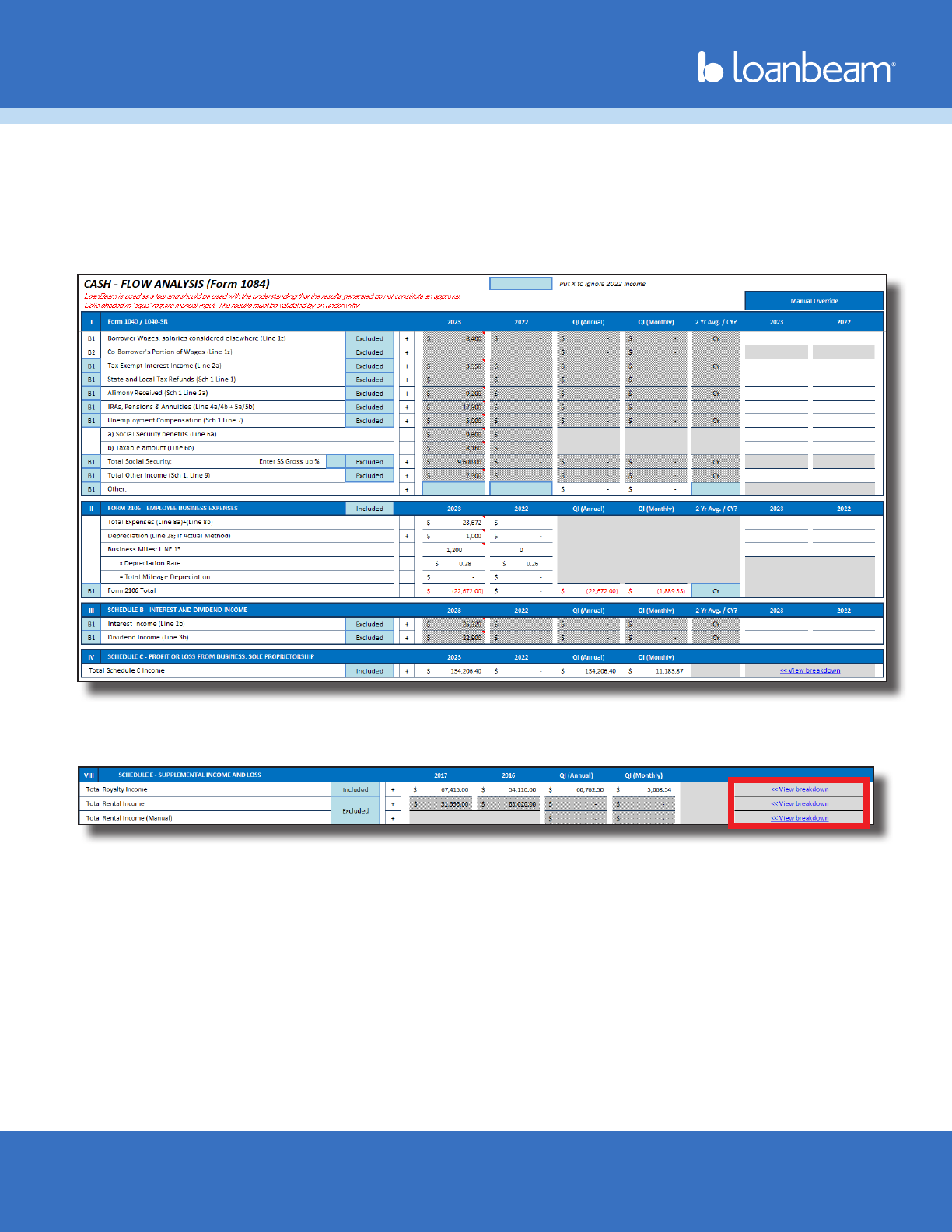

Main Sheet

The Main Sheet tab contains the borrower’s 1040 income, along with income totals from the other tabs.

While values from Form 1040, Form 2106, Schedule B, Schedule D, and Forms 4797 and 6252 are populated

solely on the Main Sheet, information from multi-instance forms, like Schedule C, Rental, Partnership, etc.,

are detailed on their own individual tabs — and only their cumulative totals are passed back to the Main

Sheet.

To easily access detailed information about multi-instance forms and schedules from the Main Sheet, click

the “View breakdown” hyperlink next to the corresponding income stream.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 154/19/2024

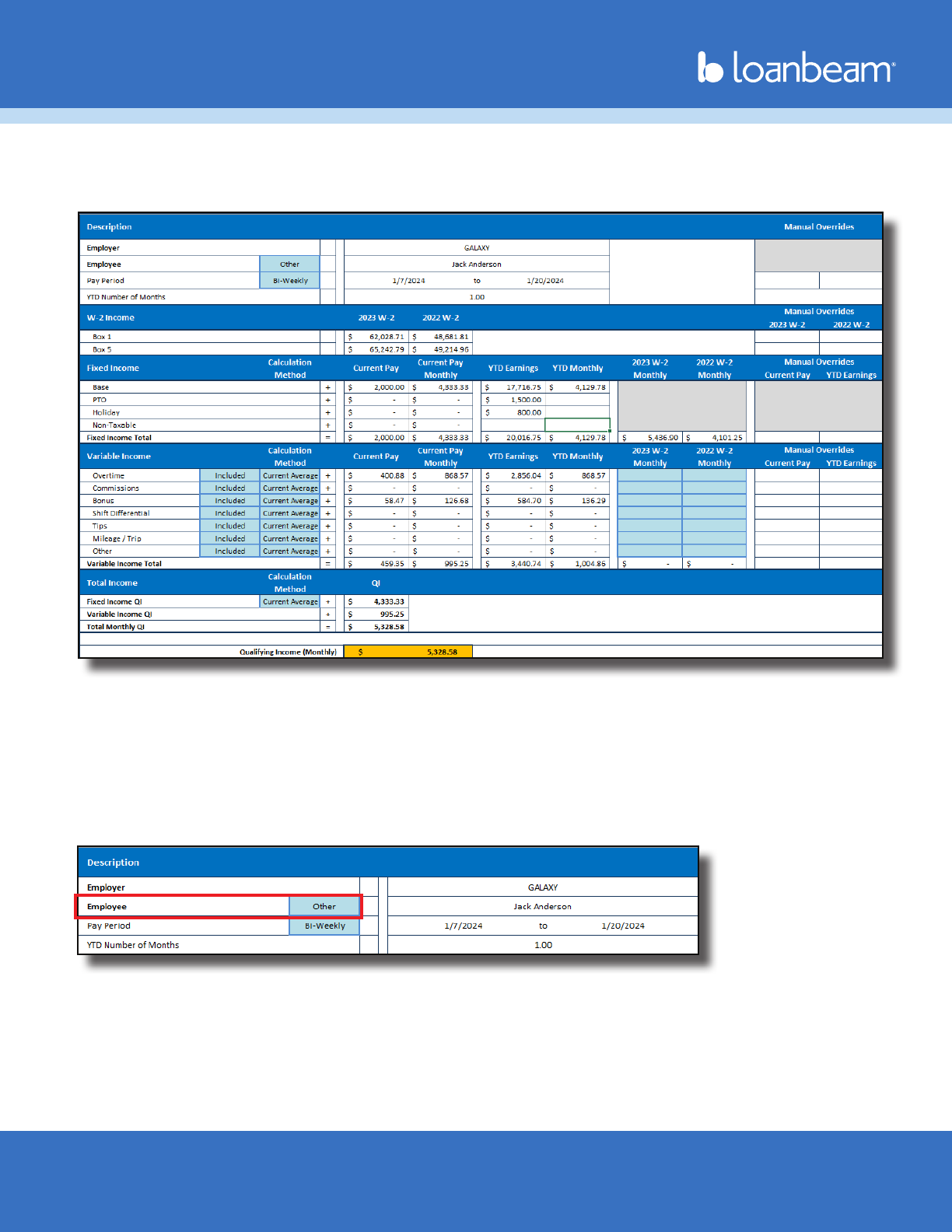

Wage Income

The Wage Income tab displays the calculated wage income earned by the borrower(s), separated by

employer.

The Description section displays Employer and Employee information, along with the borrower’s Pay

Period, Pay Frequency, and the number of months YTD based on the most recent Paystub submitted.

Paystub wages are automatically assigned to Borrower 1 or Borrower 2 based on borrower name

matching. If a Paystub name does not match a borrower, the Paystub will be assigned to “Other.” All

income assigned as “Other” is aggregated on the Summary Sheet under “Other Borrowers.”

To manually assign the income to a borrower, select the appropriate borrower via the Employee drop-

down.

If the only documents uploaded to LoanBeam are W-2 wage documents (and no tax documents are

present), then all wage income will be assigned to Borrower 1 by default. To assign the income to Borrower

2 or Other, use the Employee drop-down.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 164/19/2024

Wage Income (cont.)

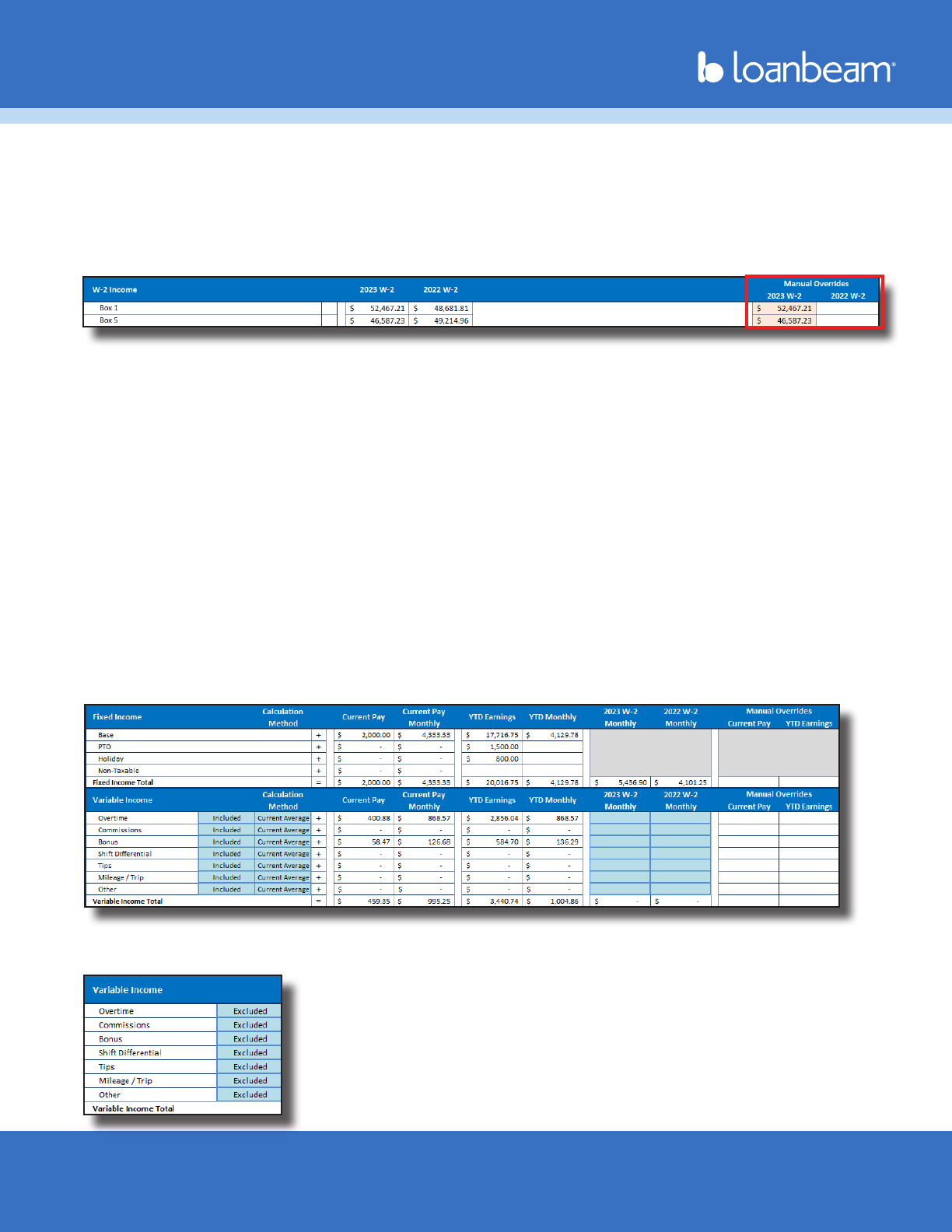

W-2 Income

W-2 Income is extracted from Box 1 and Box 5 of Form W-2 for the previous two years. This income is used

for the YTD + 12 and YTD + 24 calculation methods, if selected.

W-2 Income can be updated via the Manual Overrides columns.

Paystub Income

Wage income sections are broken down by income type and sub-type. They break down as follows:

• Fixed Income (top section)

◦ Base

◦ PTO

◦ Holiday

◦ Non-Taxable

• Variable Income (bottom section)

◦ Overtime

◦ Commissions

◦ Bonus

◦ Shift Differential

◦ Tips

◦ Mileage/Trip

◦ Other (any income the system could not identify)

To present the most conservative default calculation, variable income is excluded by default, but each

income stream may be included individually.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 174/19/2024

Wage Income (cont.)

Paystub data is separated into the following columns:

• Current Pay (Extracted Value) – amount listed as Current Pay on the borrower’s most recent paystub

• Current Pay Monthly (Calculated Value) – monthly income calculated from Current Pay

• YTD Earnings (Extracted Value) – amount listed as YTD Earnings on the borrower’s most recent paystub

• YTD Monthly (Calculated Value) – monthly income calculated from YTD Earnings

Only extracted values may be changed using the Manual Overrides column. Calculated values, (i.e.,

Current Pay Monthly and YTD Monthly) are updated automatically.

W-2 Details Section

Prior year income is derived from W-2s (if present) and displayed as a calculated value under “W-2

Monthly.” Important note! The calculated value is based on the whole amount captured from the W-2

divided by 12, regardless of how many months the person actually worked at the employer the prior year.

W-2 monthly income may be separated by specic income types. This is useful if you have VOI data from

prior year which breaks down the borrower’s income by category. As you enter monthly income in the

Variable Income section, it is automatically deducted from the Fixed Income section.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 184/19/2024

Wage Income (cont.)

Calculating Fixed Income

Fixed income is calculated as a group (Base, PTO, Holiday, and Non-Taxable) and the default calculation

method is Current Average.

To change the default calculation, use the Calculation Method drop-down, which provides four standard

calculation methods: Current Average, YTD Average, YTD + 12, and YTD + 24.

Calculating Variable Income

Variable income is excluded by default for all variable income types. To include variable income in

Qualifying Income, click the row’s Included/Excluded drop-down and select Included.

Once you’ve included a row, use the Calculation Method drop-down to choose from four standard

calculation methods: Current Average, YTD Average, YTD + 12, and YTD + 24.

Cumulative Wage Total Income

The Monthly Qualifying Income for each of your borrower’s employers is included by default in the

cumulative Wage Total Income value at the top of the Wage Income tab. To exclude income from an

Employer, change the drop-down from Included to Excluded.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 194/19/2024

Wage Income (cont.)

Including Wages in Net Qualifying Income

When paystubs are uploaded and Wage Income is calculated, Wages (Line 1z Form 1040) is deactivated

and Wage Income (Paystubs/W-2s) is activated on the Summary Sheet.

If, however, you would prefer to use wage data from Line 1z of the borrower’s Form 1040 instead of the

calculated value from the Wage Income tab, change the Borrower Wages, salaries considered elsewhere

(Line 1z) row on the Main Sheet to “Included.”

This will activate Wages (Line 1z Form 1040) on the Summary Sheet and deactivate Wage Income

(Paystubs/W-2s).

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 204/19/2024

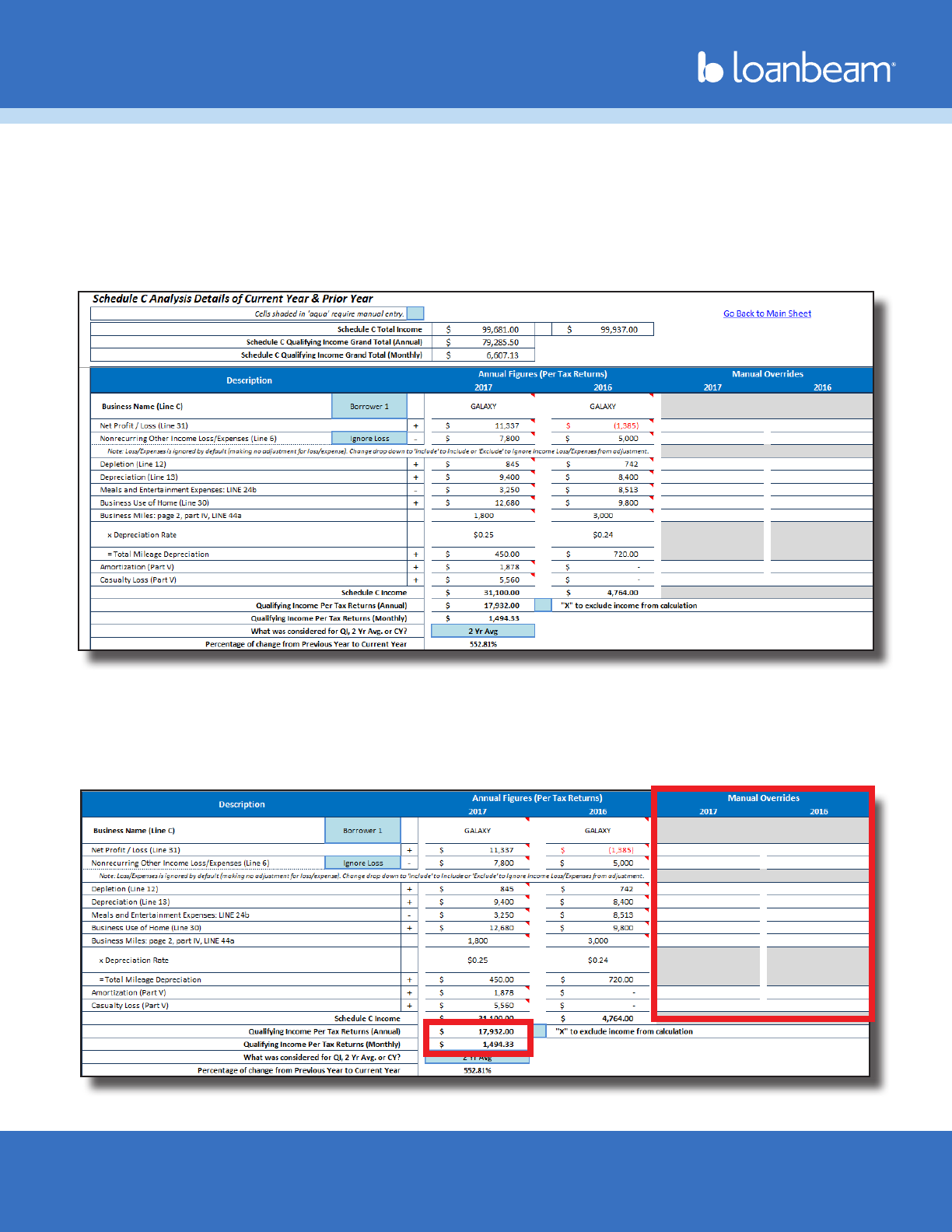

Schedule C

Repeated Income Groups

LoanBeam’s technology captures all Schedule C businesses found in the borrowers income documents

and combines them into a single tab using “Repeated Income Groups.” Each Schedule C business is

displayed on this tab as a separate income group.

Manual Overrides

In the event that any values from the income documents need to be changed, users may update the

income via the Manual Overrides columns. Once updated, the Annual and Monthly Qualifying Income

values will adjust accordingly.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 214/19/2024

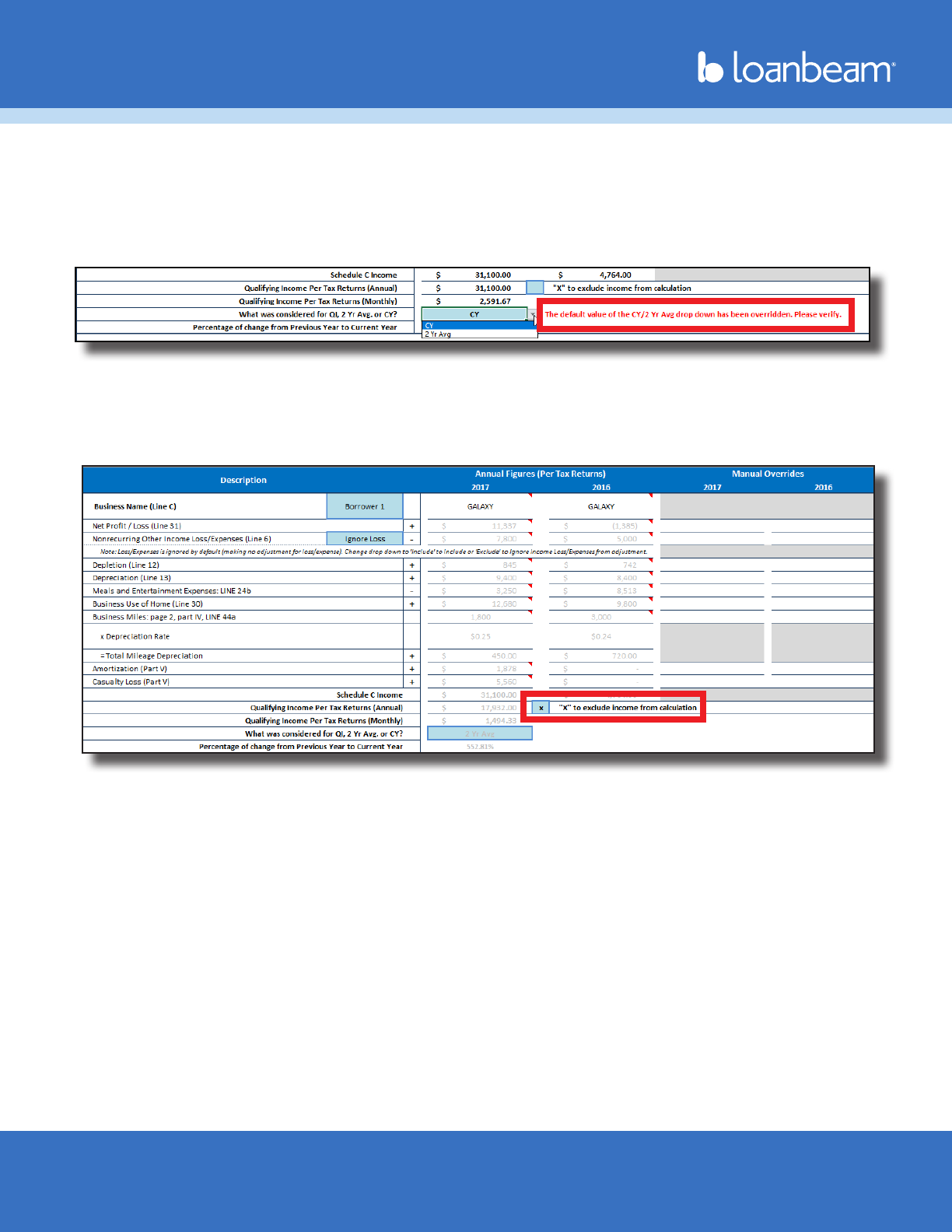

Schedule C (cont.)

Calculation Method Alert

If the default calculation method (i.e. 2 Yr Avg. or Current Year) has been overridden by changing the

drop-down option, a message indicating that the default value has been changed will appear.

X to Exclude Income

To exclude the income of any business from your borrower’s Qualifying Income, type an “X” in the box

provided. The income or loss will be excluded and grayed out.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 224/19/2024

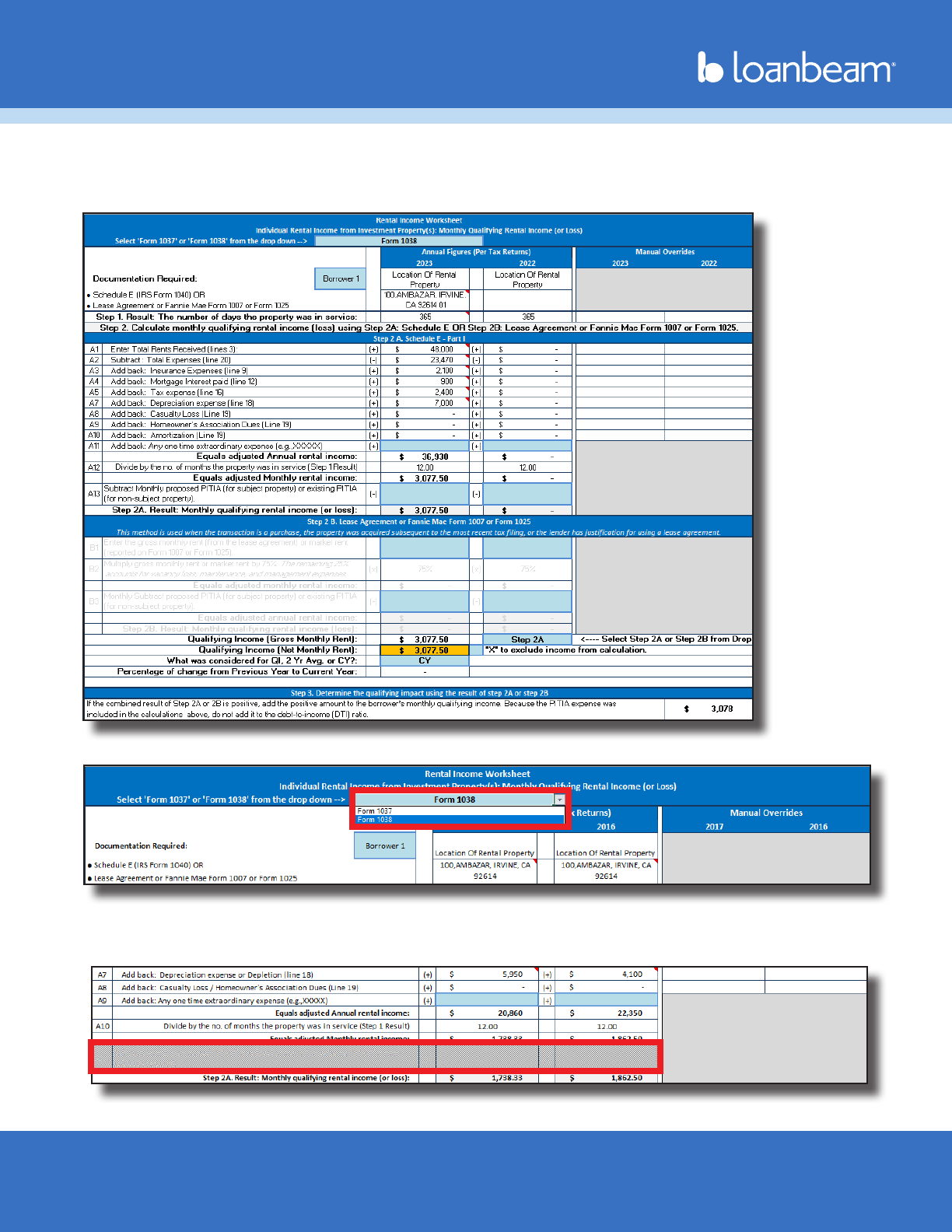

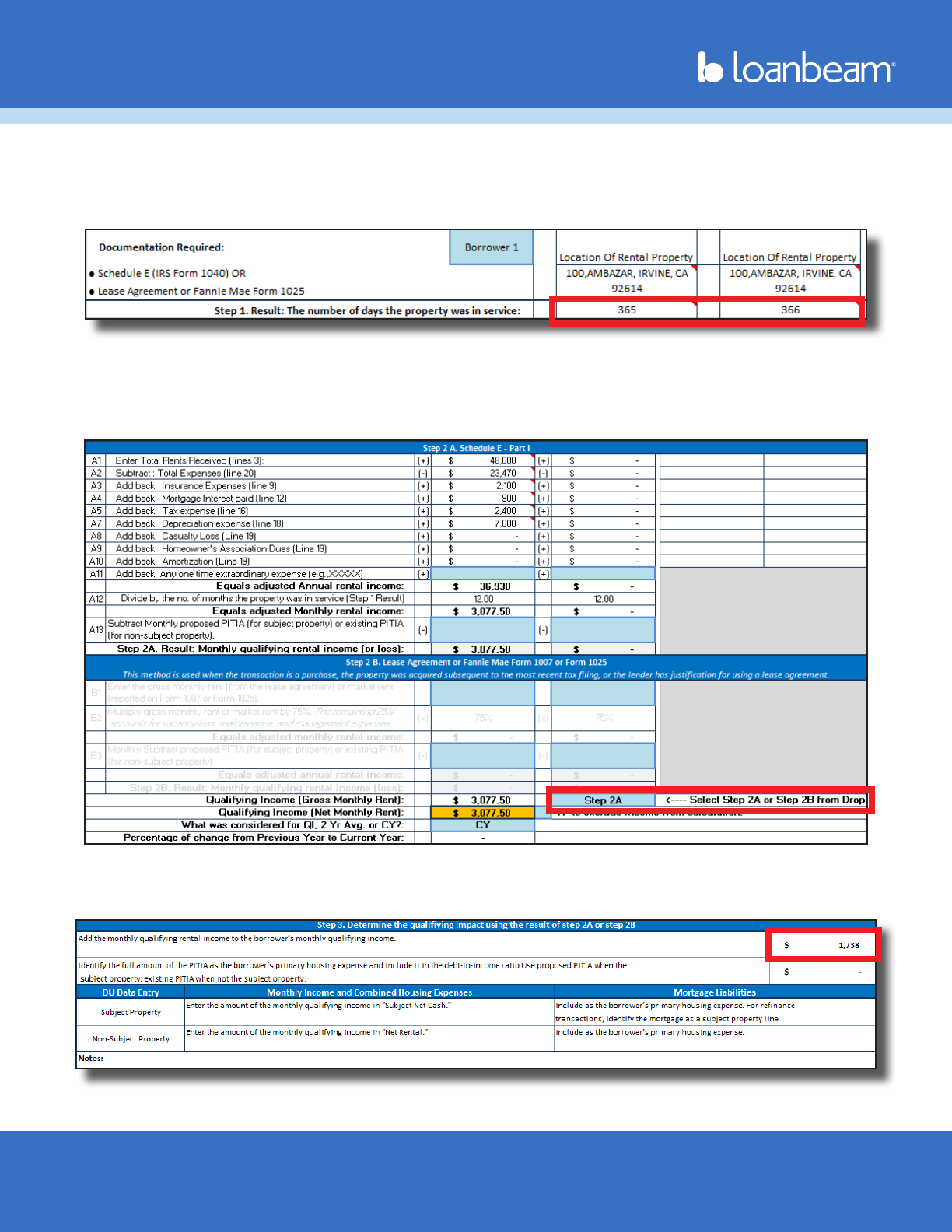

Schedule E - Rental (Fannie Mae Form 1037/1038)

The Fannie workbook uses Fannie Mae guidelines to calculate rental income or loss. There is no limit to the

number of rental properties that LoanBeam will analyze.

Select either Form 1037 or Form 1038 from the drop-down options. By default, Form 1038 is selected.

If Form 1037 is manually selected, the PITIA elds will be grayed out and PITIA income or loss will not be

included in the Qualifying Income calculations.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 234/19/2024

Schedule E - Rental (Fannie Mae Form 1037/1038) (cont.)

Three-step calculations are performed for each rental property

Step 1: The number of days the property was in service is populated from the tax return.

Step 2: Step 2 has two options. Step 2A uses the tax returns to calculate monthly qualifying rental income

or loss, while Step 2B uses the property’s lease agreement to calculate qualifying income. (For example,

Step 2B might be used if the monthly rent was increased, but was not yet reected on the tax returns.)

Select which method to use via the drop-down eld at the bottom of each repeated income group.

Step 3: The qualifying income is determined using the results from Step 1 and either Step 2A or Step 2B.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 244/19/2024

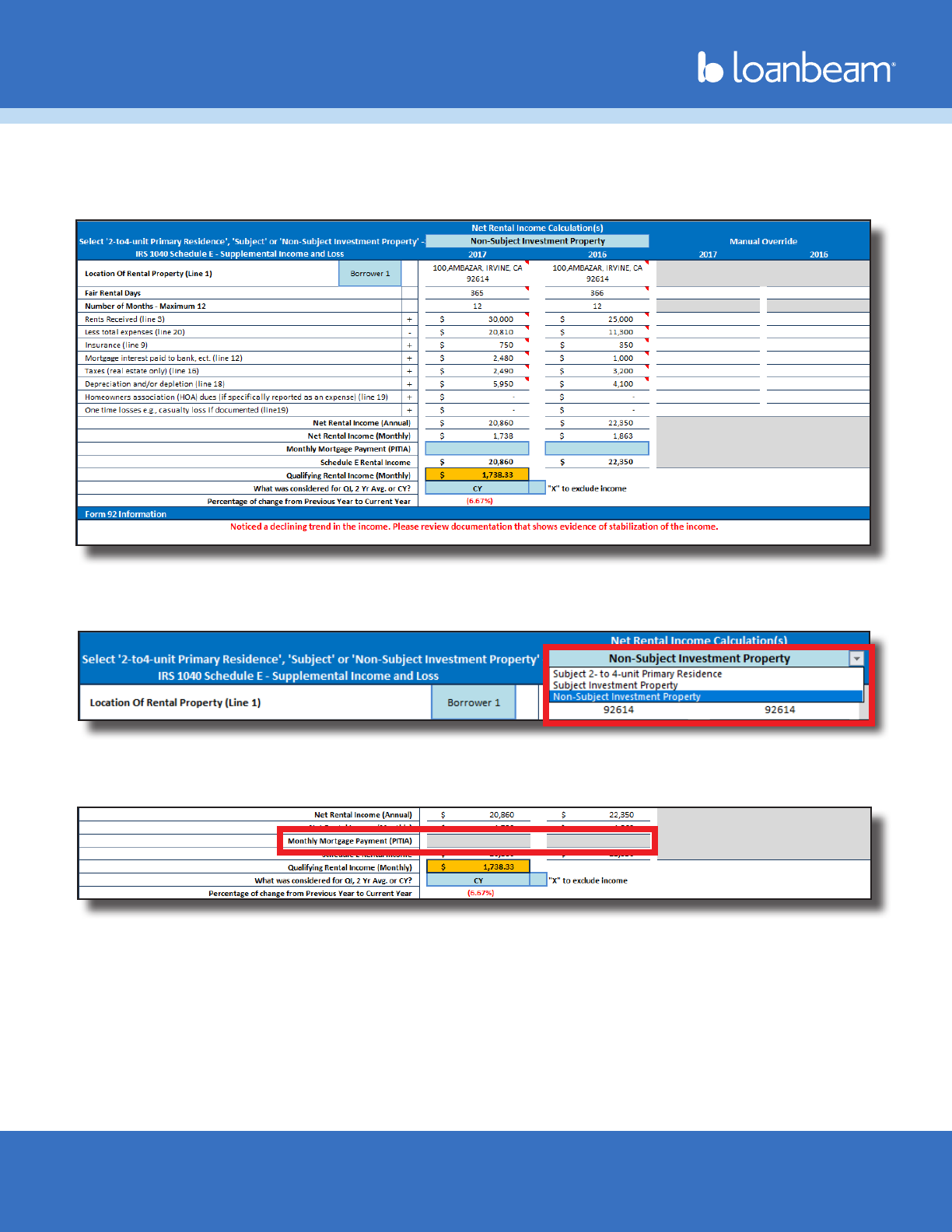

Schedule E - Rental (Freddie Mac Form 92)

The Freddie workbook uses Freddie Mac guidelines to calculate rental income or loss. There is no limit to

the number of rental properties that LoanBeam will analyze.

Select either Non-Subject Investment Property, Subject Investment Property, or Subject 2-4 Unit Primary

Residence from the drop-down options. By default, Non-Subject Investment Property is selected.

If Subject 2-4 Unit Primary Residence is manually selected, the PITIA elds will be grayed out and PITIA

income or loss will not be included in the qualifying income calculations.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 254/19/2024

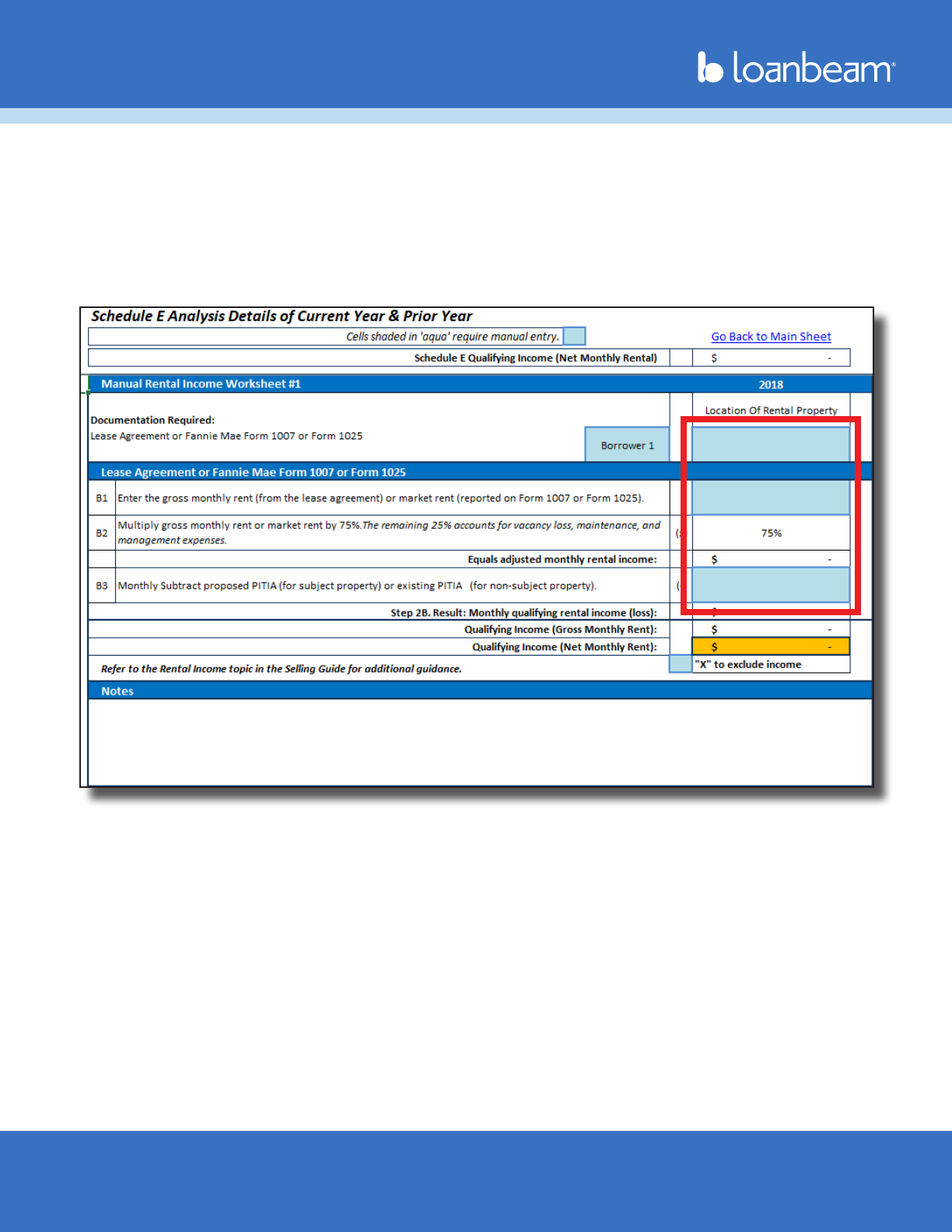

Rental (Manual)

The Rental (Manual) tab allows users to capture income or loss from newly-purchased (unseasoned) rental

properties that are not yet reected on the tax returns.

Using the light blue cells, manually enter the property address, the monthly rent, and PITIA if necessary to

calculate qualifying income or loss.

The tab contains ve unpopulated repeated income groups to record the income or loss for up to ve

rental properties.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 264/19/2024

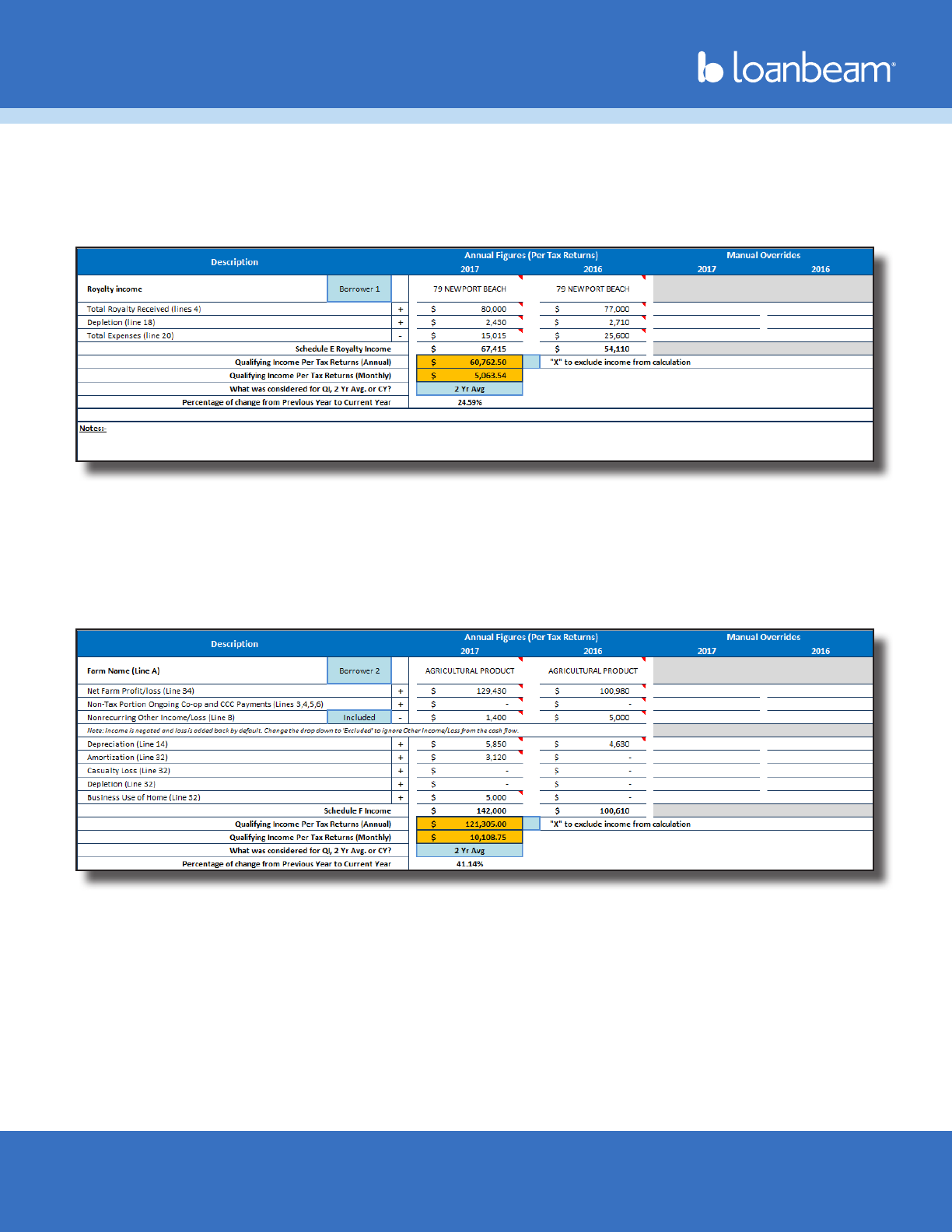

Schedule E - Royalty

The Royalty tab is populated with Schedule E income or losses that are designated as “Royalty” income.

Each entity is displayed on this tab as a separate repeated income group, and cumulative royalty

qualifying income or loss is aggregated at the top of the tab.

Schedule F - Farm

The Schedule F tab helps in the analysis of a borrower’s Farm income or loss. Each Schedule F entity is

displayed on this tab as a separate repeated income group, and cumulative farm qualifying income or

loss is aggregated at the top of the tab.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 274/19/2024

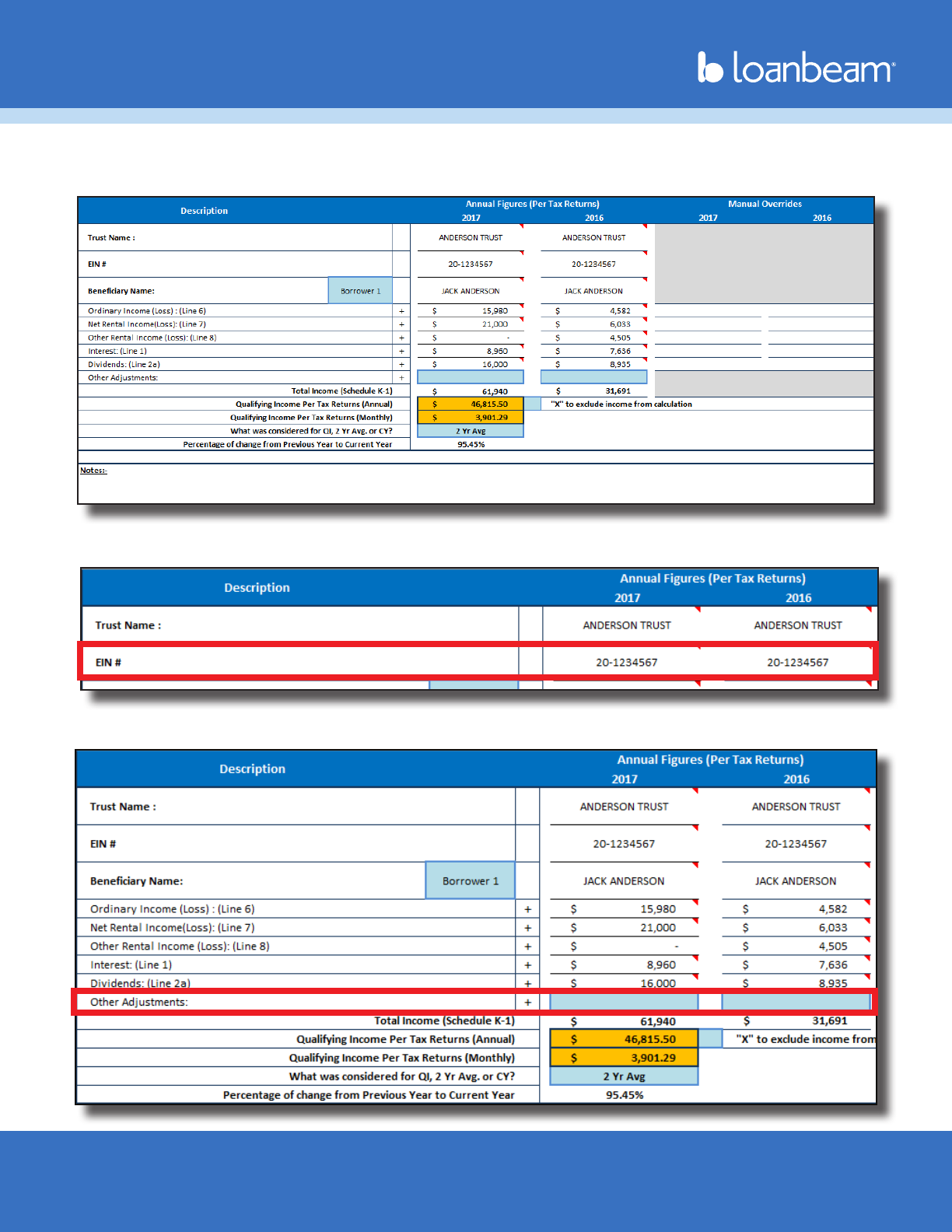

Trust

Trust income or loss is collected on the Trust tab.

Each repeated income group will include the Trust’s Name, EIN, and Beneciary.

If necessary, make adjustments to income in the elds labeled “Other Adjustments.”

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 284/19/2024

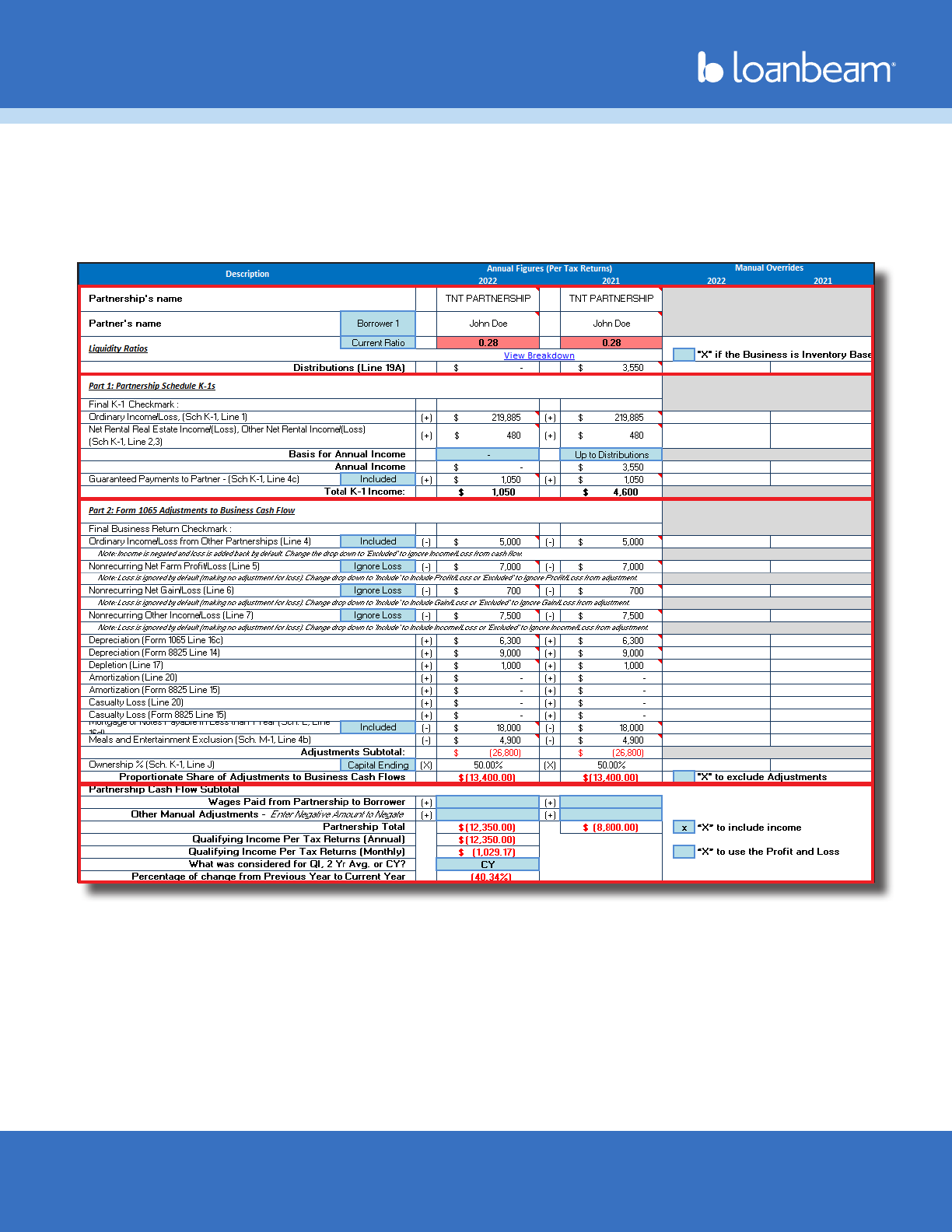

Partnership

The Partnership tab populates the borrower’s income or loss from K-1s, as well as adjustments to the

income from Form 1065.

The 1065 adjustments to business cash ow [C] are applied to the Partnership’s schedule K-1 income [B],

and are reected as the Partnership Total [D]. Qualifying Income is calculated from this total.

[A] Entity Information

[B] K-1 Income

[C] 1065 Adjustments

[D] Totals

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 294/19/2024

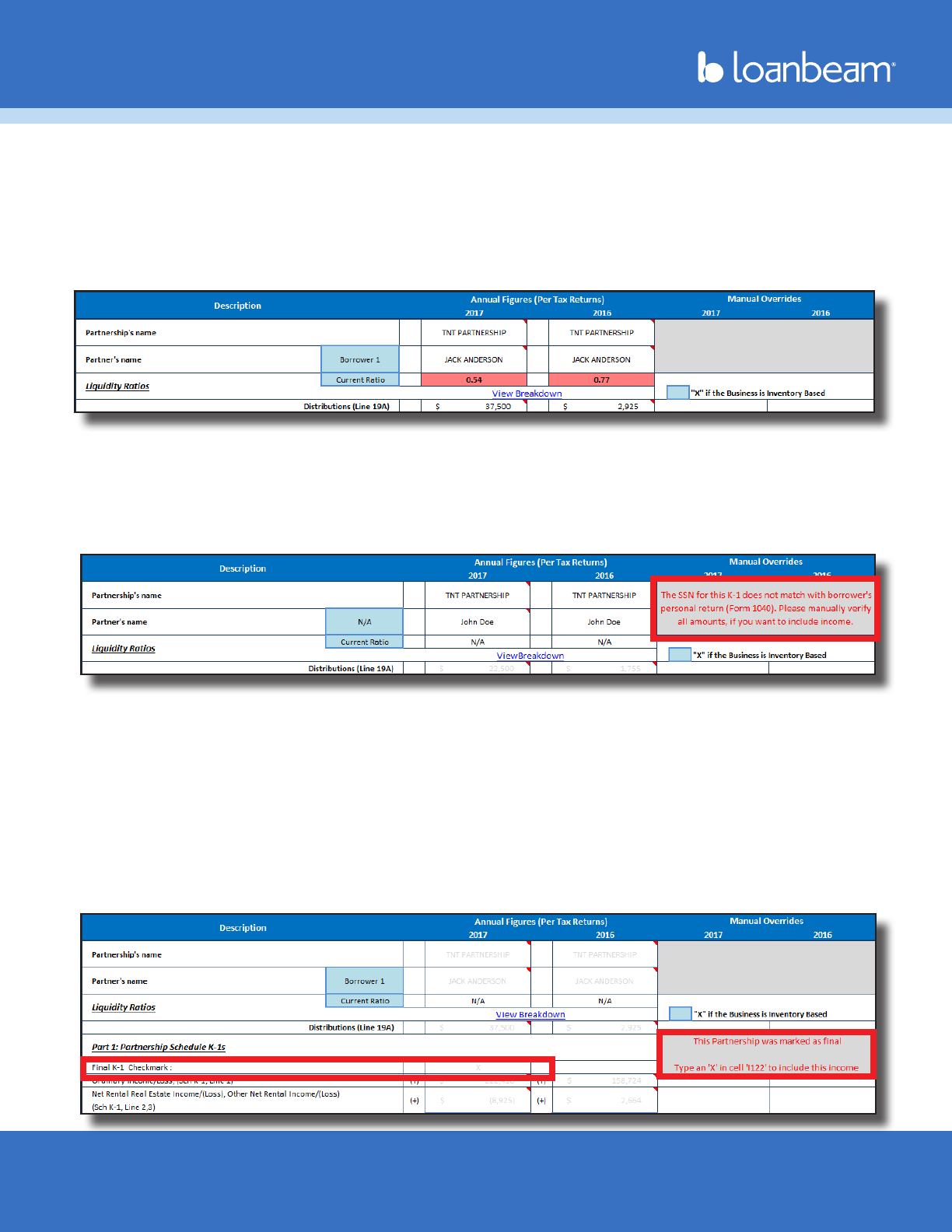

Partnership (cont.)

Each partnership “repeated income group” is divided into four sections.

[A] Entity Information

The entity information at the top of each group displays the Partnership name, partner name, liquidity

ratios (with quick and current ratios), and distributions.

If, for any reason, the borrower or co-borrower’s social security number is redacted, obscured, or does

not match the document, LoanBeam Income cannot link the income to your borrower. In these cases,

income will be disabled by default and a message will appear in the top right of the repeated income

group. If the income can be veried as belonging to the borrower, place an “X” in the “X to include

income” box in [D].

[B] Part 1 (Partnership K-1)

LoanBeam Income analyzes K-1 income from the tax returns and calculates K-1 income or loss for each

tax year.

Final K-1

Partnerships marked as Final K-1 will not be considered in the qualifying income analysis. A message

indicates if an entity is Final, and its income or loss is grayed out.

If, however, the K-1 was marked Final by mistake and you wish to include the income in qualifying income,

use the “X to include income” box in [D].

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 304/19/2024

Partnership (cont.)

Basis for Annual Income

LoanBeam Income uses either“K-1 Lines 1,2,3” or “Up to Distributions” as the Basis for Annual Income when

calculating Total K-1 Income. The FNMA SEI and SAM templates use the business’ liquidity ratios in deciding

which income to use as the basis for the calculations.

If the entity’s liquidity ratio is 1.0 or greater, then “K-1 Lines 1,2,3” is used as the Basis for Annual Income. If,

however, the entity’s liquidity ratio is less than 1.0, then it is considered not liquid and “Up to Distributions”

(up to the value of K-1 Lines 1,2,3) is used. The “Basis for Annual Income” may be manually overridden by

the underwriter.

[C] Part 2 (1065 Adjustments)

In the next section of the tab, LoanBeam Income calculates the 1065 Adjustments to Business Cash Flow.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 314/19/2024

Partnership (cont.)

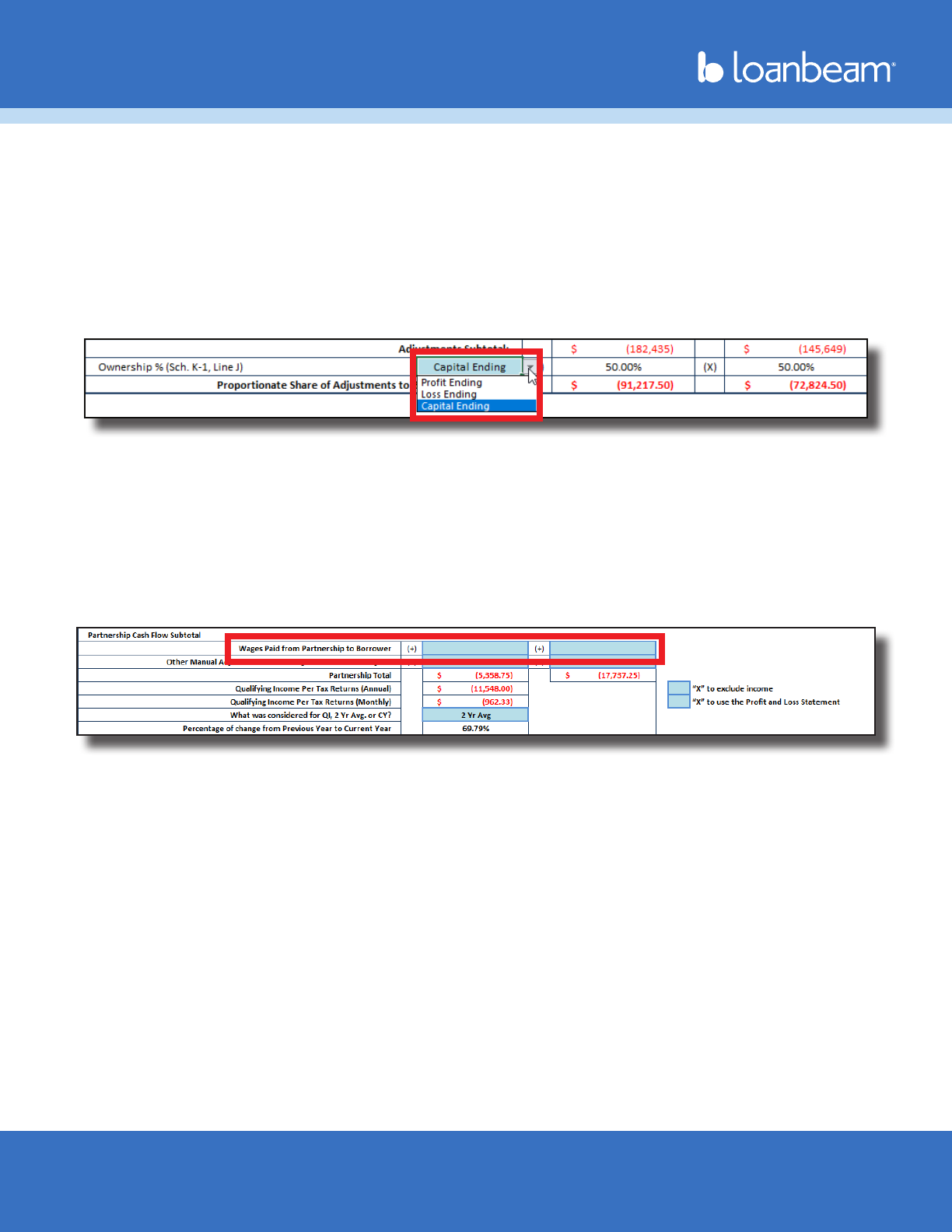

[D] Totals

In the Totals section, the 1065 Adjustments are applied to the K-1 income or loss, ultimately giving us our

qualifying income for the business.

Ownership Percentage

Ownership percentage is extracted from the borrower’s K-1 automatically. By default, the ownership

percentage is set to Capital Ending, but may be manually updated to Prot Ending or Loss Ending.

Wages Paid to Borrower

If wages from the partnership were paid to the borrower, they may be manually entered on the line

highlighted below.

Important! Wages paid to the borrower from their partnership may already be included in “Borrower

Wages, salaries considered elsewhere” section of the Main Sheet. Including the income on the

partnership’s “Wages Paid from Partnership to Borrower” line may “double dip” those wages. If you

would prefer to move income from the Main Sheet to the Partnership tab, be sure to remove it from the

“Borrower Wages” line on the Main Sheet via manual override.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 324/19/2024

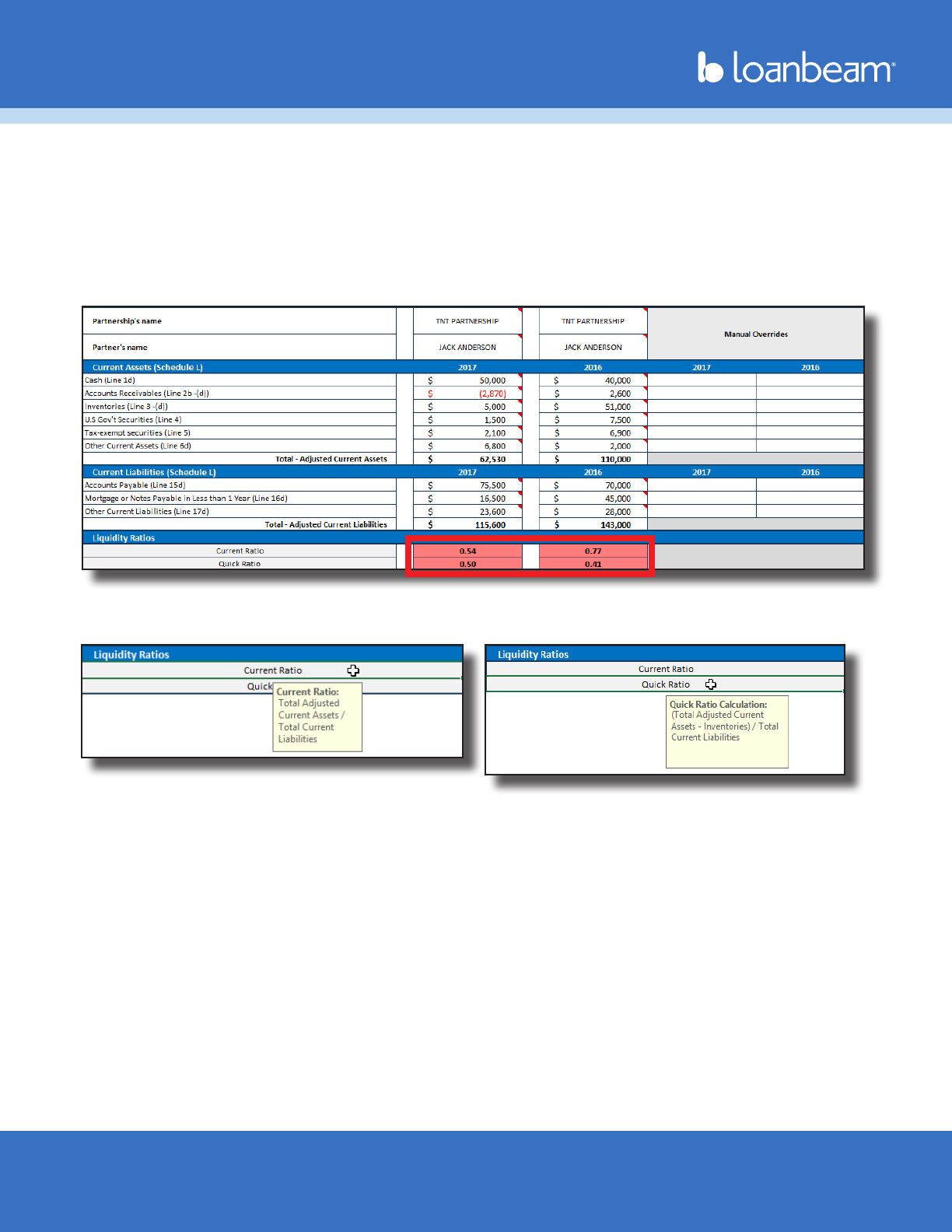

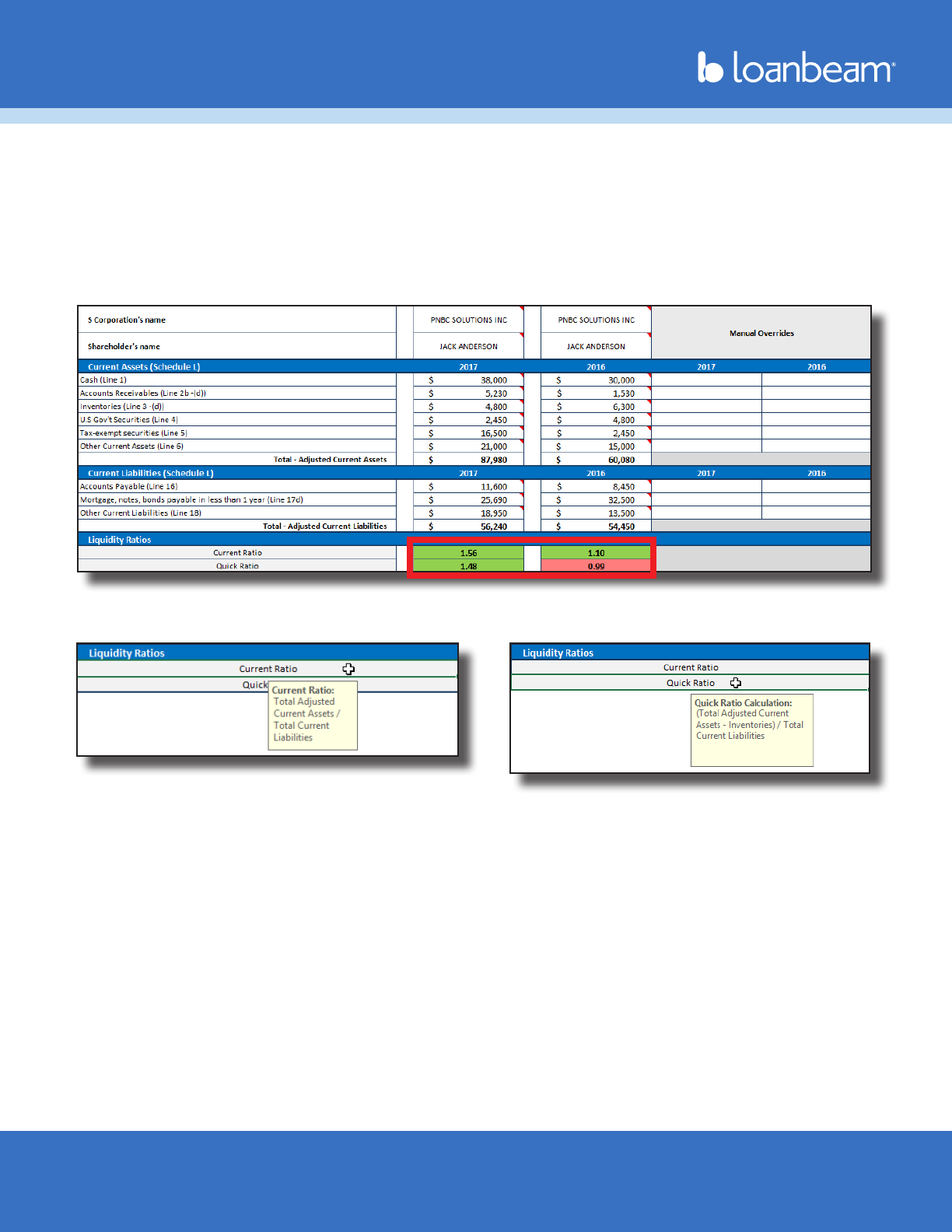

Partnership Liquidity Analysis

LoanBeam Income performs a Liquidity Analysis — using both Current and Quick Ratios — for each

Partnership. The liquidity information is pulled directly from the Schedule L.

The ratio will appear green if the Partnership is liquid (ratio > 1.0). If the business is not solvent (ratio < 1.0),

the ratio will appear red.

If the Schedule L is not present or has no values, the liquidity ratios will be zero, and the entity will not be

considered solvent.

Click the ratio name under the Liquidity Ratios header to view the formulas used to calculate the Current

and Quick Ratios.

Important! Partnership liquidity calculated on the FNMA SEI and SAM templates will help determine the

Qualifying Income of the business. Liquidity on the Freddie Mac Form 91 template is informational only and

does not affect the Qualifying Income of the business.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 334/19/2024

S Corporation

The S Corporation tab populates the borrower’s income or loss from K-1s, as well as adjustments to the

income from Form 1120S.

The 1120S adjustments to business cash ow [C] are applied to the S Corporation’s schedule K-1 income

[B], and is reected as the S Corporation Total [D]. Qualifying Income is calculated from this total.

[A] Entity Information

[B] K-1 Income

[C] 1120S Adjustments

[D] Totals

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 344/19/2024

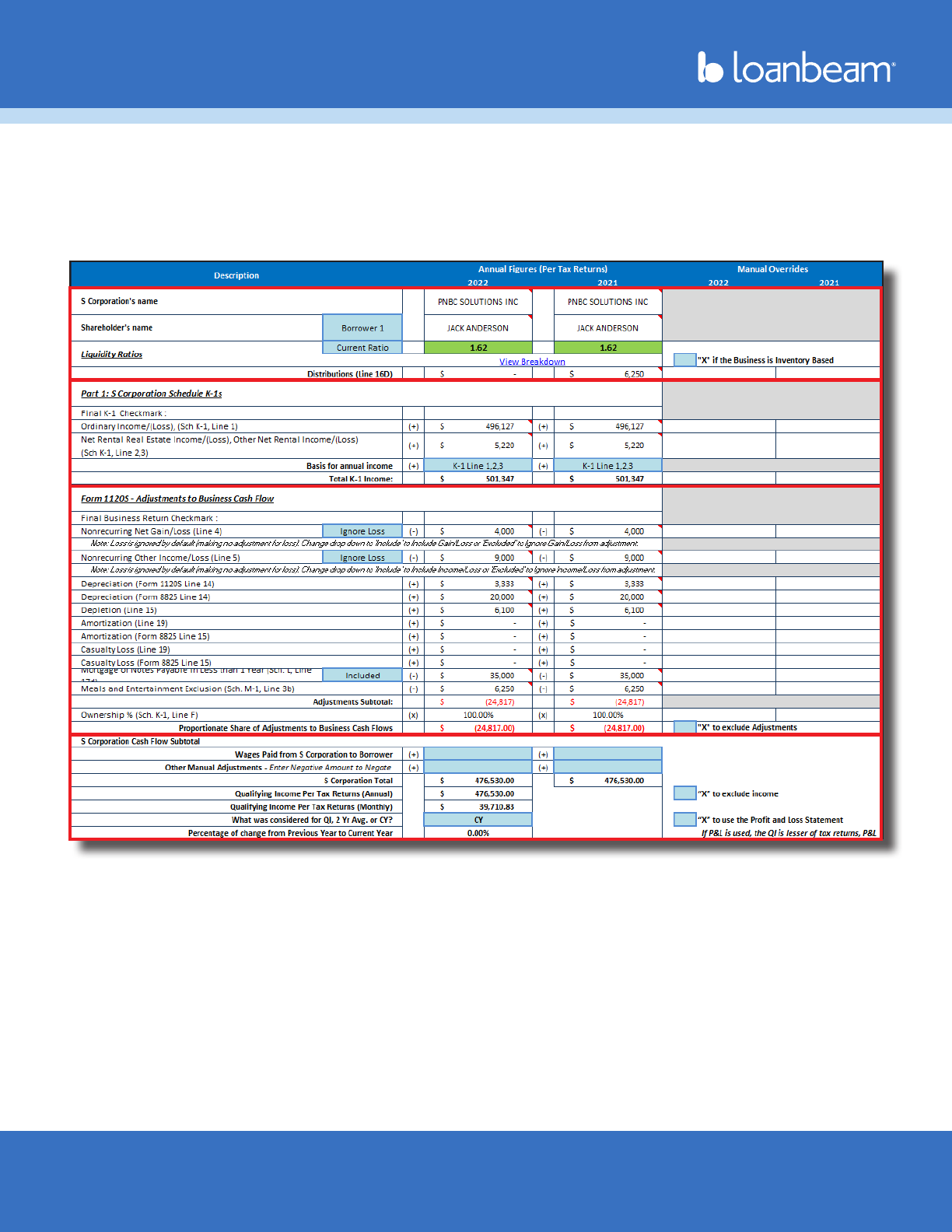

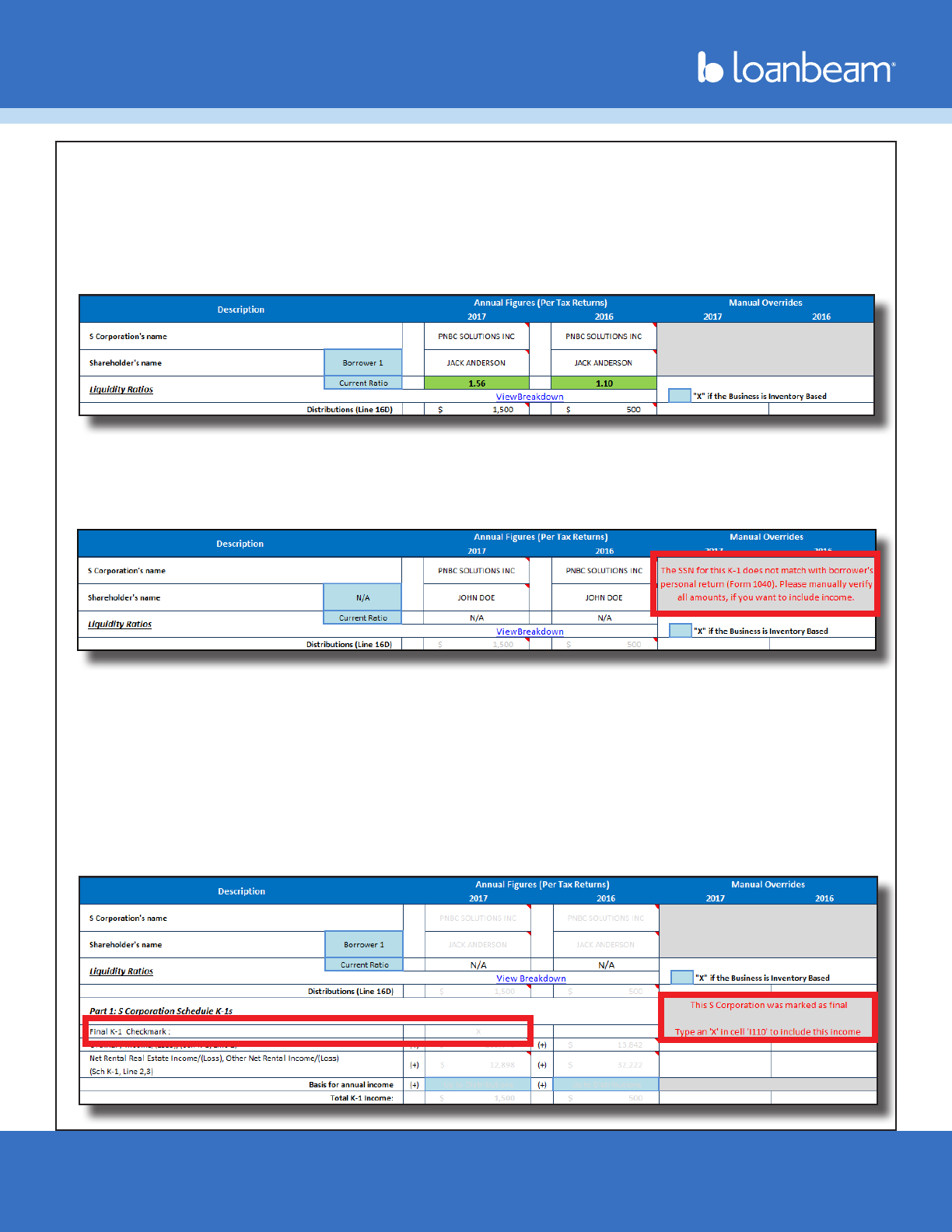

S Corporation (cont.)

Each S Corporation “repeated income group” is divided into four sections.

[A] Entity Information

The entity information at the top of each group displays the S Corporation name, shareholder name,

liquidity ratios (with quick and current ratios), and distributions.

If, for any reason, the borrower’s Social Security number is redacted, obscured, or does not match the

document, LoanBeam Income cannot link the document to your borrower. In these cases, income will

be disabled by default and a message will appear in the top right of the repeated income group. If the

income can be veried as belonging to the borrower, place an X in the “X to include income” box in [D].

[B] Part 1 (S Corporation K-1)

LoanBeam Income analyzes K-1 income from the tax returns and calculates K-1 income or loss for each

tax year.

Final K-1

S Corporations marked as Final K-1 will not be considered in the qualifying income analysis. A message

indicates if an entity is Final, and its income or loss is grayed out.

If, however, the K-1 was marked Final by mistake and you wish to include the income in qualifying income,

use the “X to include income” box in [D].

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 354/19/2024

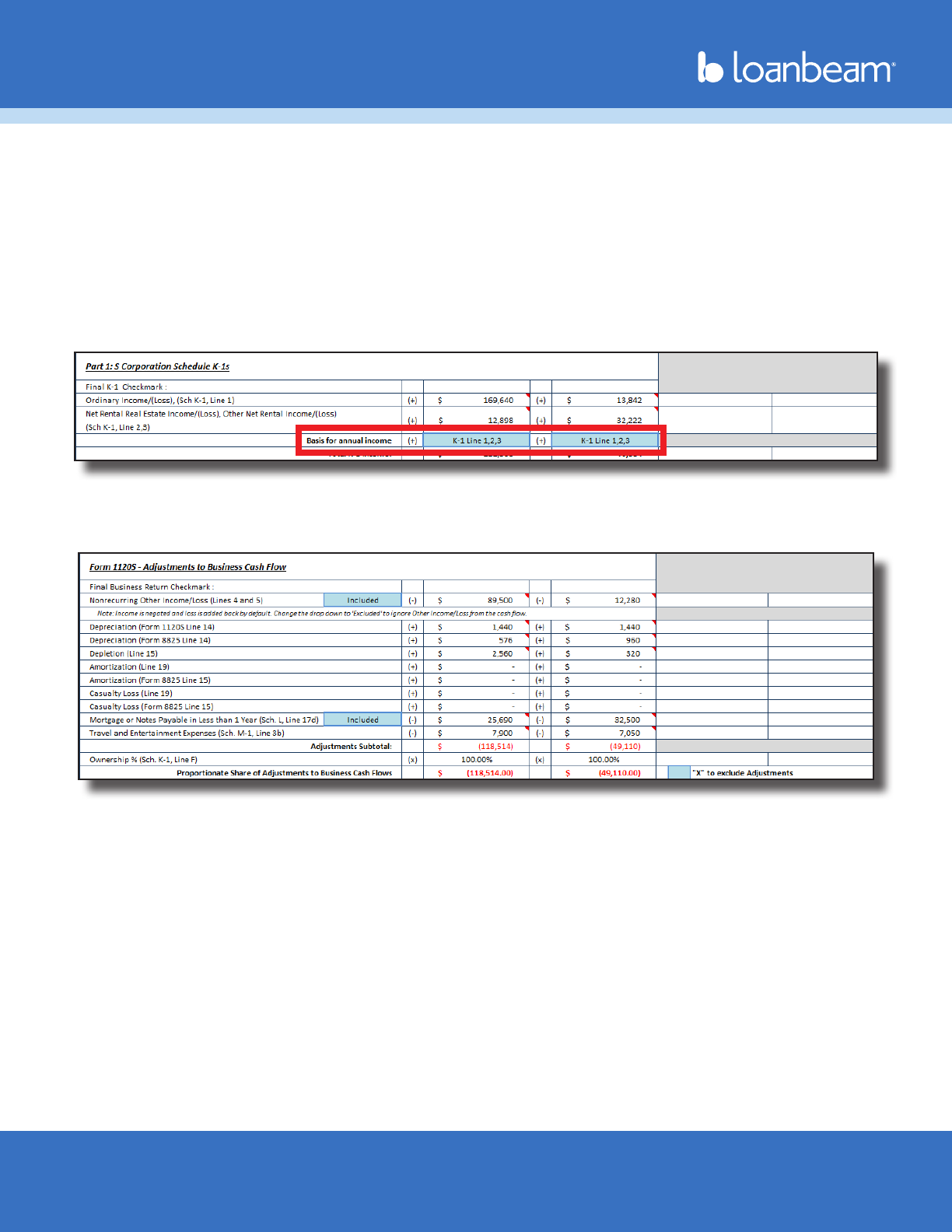

S Corporation (cont.)

Basis for Annual Income

LoanBeam Income uses either “K-1 Lines 1,2,3” or “Up to Distributions” as the Basis for Annual Income when

calculating Total K-1 Income. The FNMA SEI and SAM templates use the business’ liquidity ratios in deciding

which income to use as the basis for the calculations.

If the entity’s liquidity ratio is 1.0 or greater, then “K-1 Lines 1,2,3” is used as the Basis for Annual Income. If,

however, the entity’s liquidity ratio is less than 1.0, then it is considered not liquid and “Up to Distributions”

(up to the value of K-1 Lines 1,2,3) is used. The “Basis for Annual Income” may be manually overridden by

the underwriter.

[C] Part 2 (1120S Adjustments)

In the next section of the tab, LoanBeam calculates the 1120S Adjustments to Business Cash Flow.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 364/19/2024

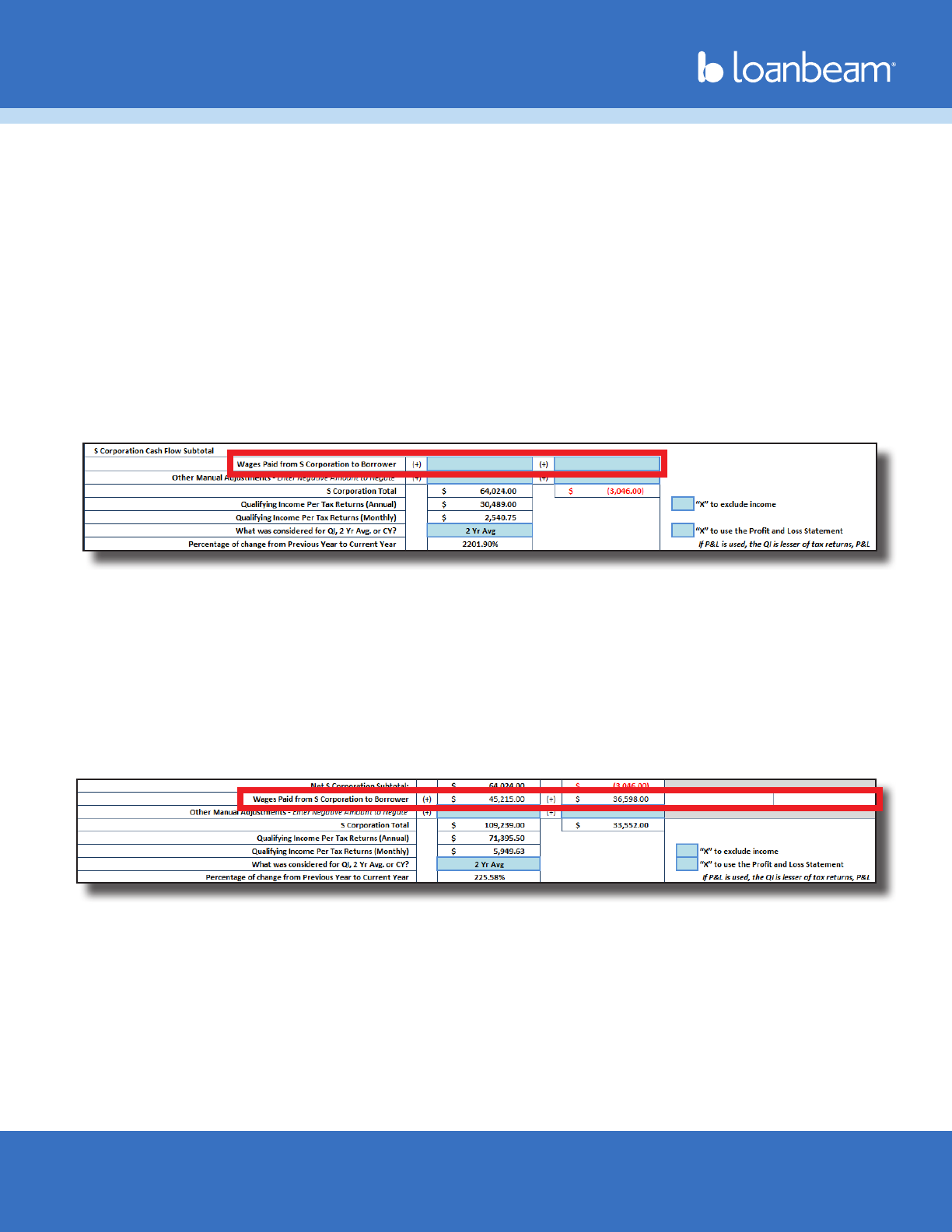

S Corporation (cont.)

[D] Totals

In the Totals section, the 1120S Adjustments are applied to the K-1 income or loss, ultimately giving us our

qualifying income for the business.

Wages Paid to Borrower (FNMA SEI 1084)

On the Fannie Mae SEI template, if wages from the S Corporation were paid to the borrower, they may be

manually entered on the line highlighted below.

Important! Wages paid to the borrower from their S Corporation may already be included in “Borrower

Wages, salaries considered elsewhere” section of the Main Sheet. Including the income on the S

Corporation’s “Wages Paid from S Corporation to Borrower” line may “double dip” those wages. If you

would prefer to move income from the Main Sheet to the S Corporation tab, be sure to remove it from the

“Borrower Wages” line on the Main Sheet via manual override.

Wages Paid to Borrower (Freddie Mac Form 91)

On the Freddie template, if wages from the S Corporation were paid to the borrower and the W-2 was

scanned by LoanBeam, the wages will automatically populate the Wages Paid elds. If the W-2 was not

scanned, wages may be manually entered via the override columns to the right.

Important! Wages paid to the borrower from their S Corporation may already be included in “Borrower

Wages, salaries considered elsewhere” section of the Main Sheet. Including the income on the S

Corporation’s “Wages Paid from S Corporation to Borrower” line may “double dip” those wages. If you

would prefer to move income from the Main Sheet to the S Corporation tab, be sure to remove it from the

“Borrower Wages” line on the Main Sheet via manual override.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 374/19/2024

S Corporation Liquidity

LoanBeam Income performs a Liquidity Analysis — using both Current and Quick Ratios — for each S

Corporation. The liquidity information is pulled directly from the Schedule L.

The ratio will appear green if the S Corporation is liquid (ratio > 1.0). If the business is not solvent (ratio <

1.0), the ratio will appear red.

If the Schedule L is not present or has no values, the liquidity ratios will be zero, and the entity will not be

considered solvent.

Click the ratio name under the Liquidity Ratios header to view the formulas used to calculate the Current

and Quick Ratios.

Important! S Corp liquidity calculated on the FNMA SEI and SAM templates will help determine the

Qualifying Income of the business. Liquidity on the Freddie Mac Form 91 template is informational only and

does not affect the Qualifying Income of the business.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 384/19/2024

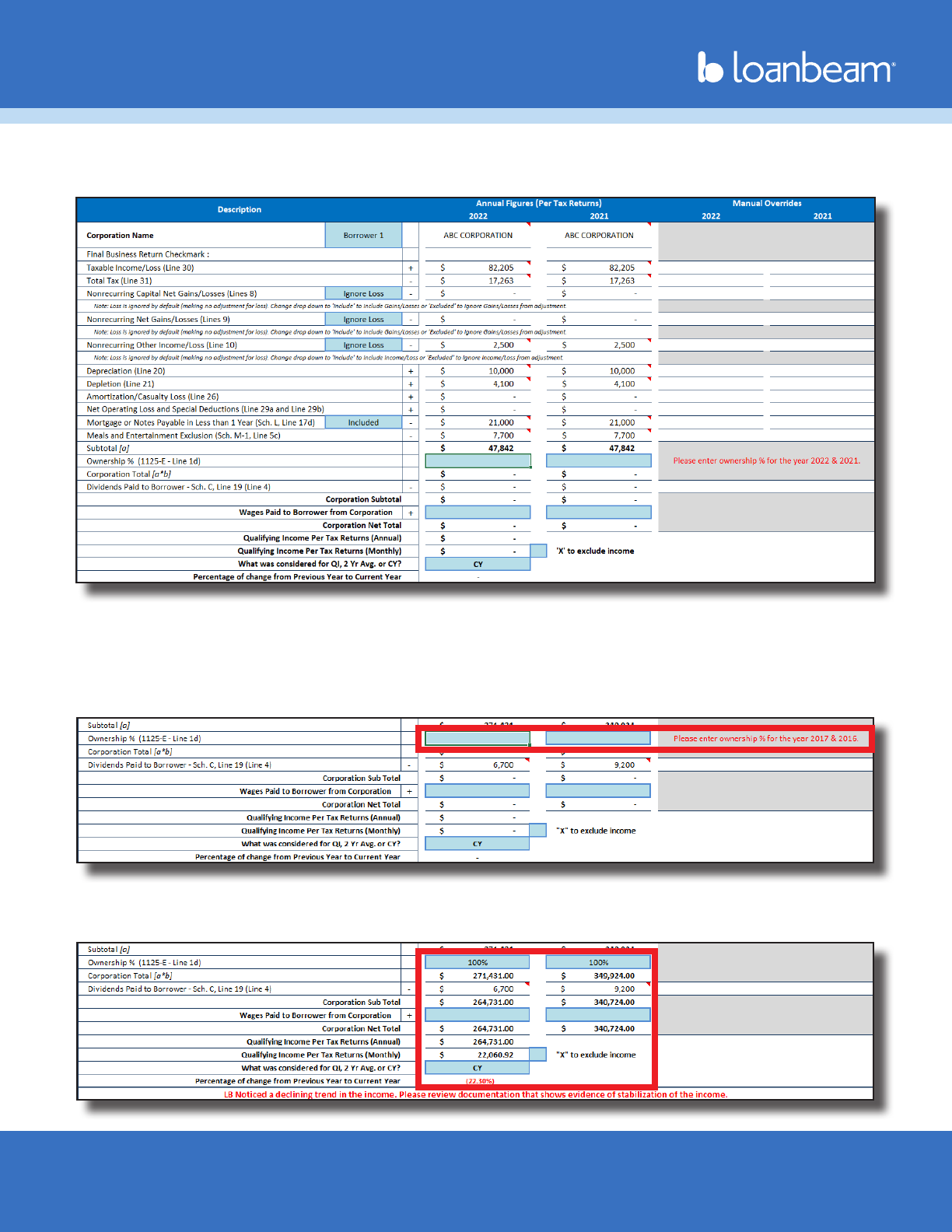

Corporation

Income or loss from type C Corporations (Tax Form 1120) will appear on the Corporation tab.

Users must manually enter the borrower’s ownership percentage, as this information is not included in the

tax returns. Until this eld is manually entered, a ag appears: “Please enter ownership % for the tax years.”

Important! If the borrower’s ownership percentage is not manually entered, the borrower will get no credit

for the income or loss.

Once the ownership percentage is manually entered, the borrower’s qualifying income or loss and

associated information is revealed.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 394/19/2024

Corporation (cont.)

By default, Corporation “nonrecurring” income is set to “Ignore Loss.” This income can be manually

assigned to Included or Excluded, if desired.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 404/19/2024

Transcripts Comparison

The Transcripts Comparison tab may be used to quickly assess whether the income documents presented

to you match what was sent to the IRS. Upload the borrower’s tax transcript results PDF using the Transcript

Comparison tab. Specic data values will be extracted and compared.

Workbook User Guide

Property of LoanLogics, Inc. All Rights Reserved. 414/19/2024

Copyright

Copyright © 2024 LoanLogics, ALL RIGHTS RESERVED. This documentation and the information, data,

software product described, and other material contained herein (collectively, “Documentation”) is

protected by United States and international copyright laws and is distributed under a software license

agreement signed by you (“Agreement”) restricting its use, copying, distribution, and recompilation. No

part of this Documentation or the software product described herein may be reproduced, utilized, or

transmitted in any form by any means whatsoever without prior written authorization from LoanLogics.

Condentiality

The software product and technology described in this Documentation is condential and proprietary

to LoanLogics and contains trade secrets of LoanLogics. Your use of this Documentation is subject to the

restrictions specied in the Agreement under which you obtained specic and limited rights to use this

Documentation.

EXCEPT AS EXPRESSLY STATED IN THE AGREEMENT, THIS DOCUMENTATION IS PROVIDED “AS IS” WITHOUT

WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED

WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. IN NO EVENT WILL

LOANLOGICS BE LIABLE FOR ANY SPECIAL OR CONSEQUENTIAL DAMAGES ASSOCIATED WITH ANY USE OF

THIS DOCUMENTATION.

These training materials are intended to familiarize clients with LoanLogics services. These training materials

are not to be distributed outside your organization and are intended for your internal use only. Any

changes made to these training materials by you, as a client, are done at your own risk and may not

accurately reect the functionality of the services provided by LoanLogics. Consequently, LoanLogics

accepts no responsibility or liability resulting from changes to these materials that you make for your

internal purposes.