SCHOOL OF MANAGEMENT STUDIES

UNIT – I - OFFICE MANAGEMENT – SBAA1407

1

I. FILING AND INDEXING

1.1 DEFINITION OF OFFICE

―An office is the administrative centre of a business. The purpose of an office has been defined

as the providing of a service of communication and record‖- Mills & Standing Ford.

―An office is a place where business is transacted or professional service is available‖-

1.2 FUNCTIONS OF MODERN OFFICE

I

Basic Functions

Receiving and collecting information

Recording information

Arranging and processing of information

Storing of data

Communication of recorded data

II

Administrative functions

Management functions

Office systems and procedures

Designing and purchasing of office forms and stationery

Selection and purchase of office furniture, equipments and machinery

Public relation function

Retention of records

Safeguarding of office assets

Controlling office cost

I.

Basic Functions (or) Routing Functions:

(a)

Receiving and collecting information: It is the primary function of office to receive and

collect the information for timely business decisions. Information is generally collected both

from Internal sources such as letters, memos, circulars, notices etc., issued by different

departments, sections and External sources like government departments, financial

Institutions, banks, suppliers, customers, universities, general public etc.

(b)

Recording of information: The collected Information has to be recorded for future

reference in a suitable form. This recorded information is needed for preparing future plans,

policies and taking decisions.

(c)

Arranging (or) Processing of Information: All the information received cannot be used

as it is. Office has to convert the collected information in the form of notes, reports,

2

diagrams, graphs etc., depending upon the nature of information for easy access and

understanding.

(d)

Storing Data: The recorded information should be protected for future reference. The

degree of necessity of data will determine the duration for protecting the same. Based on the

importance of data, office will store them in a separate file.

(e)

Communication of Recorded Data: Office has to supply the right information at the

right time to different departments and also to outside bodies who are related in some way or

the other for prompt and sound business decisions.

II.

Administrative Management Functions:

For the smooth functioning of the office there are certain administrative functions needed to be

performed. These functions are outlined below:

1.

Management Functions: Office work has to be properly planned, organized and executed

according to the plan. For efficient functioning of an office the manager has to perform the

following function such as.

Planning.

Organizing.

Staffing.

Directing.

Communication.

Controlling.

Co-ordination.

Motivation.

2.

Developing Office Systems and Procedures: Most important function of the office is to plan

and set up suitable systems and procedures for the major activity of office. For the efficient and

economical performance of office operations, each major work of the office is to be carefully

planned and also the routine procedures for performing them to be determined beforehand

itself.

3.

Form Designing and Control: A form is a standardize record, which is used to accumulate

and transact information for reference purposes. These forms serve as a storehouse of

information. Since the office work is largely paper work, the form used should be designed so

as furnish the required information in an appropriate manner. It is the duty of the office to

design the forms that can be used in various departments.

3

4.

Purchasing and Supply of Office Stationery: Majority of office work are paper work.

Consequently adequate supply of office stationery of suitable quality is of prime importance

for the systematic and efficient performance of office work. It is the task of office to look after

the standardization, selection, and purchase of office stationery and its distribution to different

departments.

5.

Selection and Purchase of Office Furniture, Equipment and Machines: The office has to

select and purchase the right type of furniture, equipment and machines in right quantities, so

that office work can be carried out according to the planned system and routine without any

interruptions and must also ensure their fullest utilization in the organization.

6.

Public Relations Functions: An office has not only maintained relations with the other

departments, it also needs to maintain a good dealings with the outside world such as

suppliers, customers, bankers, government departments and the public at large. Maintaining

good relations with these stakeholders increases the reputation and goodwill of the company.

7.

Retention of the Records: Records are those documents which serves as objective evidence

of activities performed, events occurred, results achieved, or statements made. They are created

/received by an organization in routine transaction of its business or in pursuance of its legal

obligations. Office retains records such as correspondence, invoices, orders, financial and cost

records, and minutes etc., for future reference.

8.

Safeguarding Assets: It is one of the functions of office to safeguard the assets of the

organization, such as immovable assets like buildings, plants, machinery, office equipment,

lighting and air conditioning equipment, and movable assets like furniture, office machinery,

title deeds, records and documents, or cash, etc., against loss or damages from unforeseen

conditions.

9.

Controlling office Costs: With the adoption of scientific methods in office management, a

modern office discharges the function of controlling office costs through (a) Mechanization of

the office. (b) Adopting time and labour saving devices in the office. (c) Using better forms. (d)

Analyzing the existing office routines and adopting improved ones.

1.3 IMPORTANCE OF OFFICES

An office is an important unit of the whole organization which is also regarded as the

mainspring of a watch. It has its equal importance in the government sector as well as in the

private sector. It is essential for the office to perform a number of administrative as well as

clerical functions in the process of achieving the organizational objectives.

4

(a)

Information Center: The office serves as an information center. It collects information

from sources like invoices, letters, memos, agreements, vouchers etc., and protects them in safe

mode on the basis of their importance for future reference.

(b)

Proof of Existence: The office is the evidence for existence and survival of business. As

office coordinates the functions of different departments of an organization, without office no

business house can survive. People tent to generalize about the existence of business only with

the help of regular functioning of an office.

(c)

Channel of Communication: The office is the channel of communication between

different people and department of business. The staffs working at various levels of managerial

hierarchy are linked with one another through office. Office transmits the information about the

functioning of different departments such as personnel, finance, production and marketing with

each other.

(d)

Co-Ordination of Work: Business is divided into department and subunits for bringing

simplicity in the operation. The office will work as a coordinator to maintain the relationship

between departments. It develops productivity relationship to achieve common goals of an

organization.

(e)

Centre for Formulation and communication of plan and policies: A business is

established with the objective of attaining the certain result. To achieve this result top level

manager formulate plans and policies from office. These plan and policies are communicated

to related person through the office. Therefore, the office is a center for the formulation and

communication of plans and policies.

(f)

Managerial Control: The process of developing performance standard and comparing with

actual performance in order to take corrective action for deviations if any is called controlling.

The office helps in controlling the activities of different people and department of an

organization. Through controlling it ensures that the various activities of business are

performed with much accuracy.

(g)

Memory Center: Office protects important information of past in a safe manner. The

departments and people generally collect needed data from the office as and when they are

required. It provides information storage facilities in the form of files and devices on the basis

of their importance for future reference. Therefore, the office is considered as memory center.

(h)

Service Center: The office works as a service center for different units and departments of

an organization. It provides clerical services like mailing, filing, typing, printing, supplying

resource etc., to all people working in different departments of an organization.

5

1.4 TYPES OF OFFICE:

Front office: The front office otherwise called reception. It refers to a company‘s

department that come in contact with outsiders such as clients, suppliers, bankers, financial

institutions and general public at large. The front office welcomes visitors, deals with queries

of the visitors, and receives mails and disseminates the same to respective departments.

The Middle Office: The middle office is usually a part of operations division of the

business unit. These divisions ensure the proper flow of work within the organisation. Middle

office generally functions along with the front office and it comprises of departments of

financial services. Due to their critical role, it is supervised by the back office managers.

Electronic Office: It is integrated computer systems designed to handle office work. In

this office all the activities are carried out with the help of software applications. The aim of e-

office is to reduce paper work and speed up business operations. The introduction of e-office

improves accuracy and efficiency of organizations and thereby improved their level of service

Virtual Office: ―Virtual Office‖ implies mobile or remote work environment equipped

with telecommunication links and basic office furniture, but without a fixed office space.

Office automation has led to the development of virtual office concept. It works just like a

physical office but without physical space and facilities. Employees interact with others

through portable communication tools such as electronic mail, cellular phone, voice mail

system, laptop computer, fax machine, and audio/video conferencing system. Employees

armed with these tools can perform their work from any place — their homes, cars, restaurants,

airports, customers‘ offices, and so on.

Back Office: These offices are generally found in operating corporate organizations

where tasks dedicated to operating the company are performed. The term comes from the

building layout of early organizations here the front office would contain the sales and other

costumer-facing staff and the back office would be those manufacturing or developing the

products or involved in administration but without being seen by customers. Although the

operations of back office are usually not given a lot of consideration, their contribution to the

business is significant.

1.5 OFFICE MANAGER

An office manager is an individual, who is in-charge of an office and whose function is to

organize and control the activities of the office. He is appointed to head the office. ―The office

manager is the pivot around which the office function revolves‖ (Denyer, J.C.).He extracts the

work from the subordinates to achieve organizational goals. It is his responsibility to plan,

organize and control the clerical aspects of the organization including the preparation,

6

communication, coordination and storage of data to support production and other important

operations of industrial establishments. He monitors the work processes and evaluates their

outcome. On the whole he is appointed as an administrative head of office. Today, in the

modern era of dynamic and competitive business environment, the office manager has to

perform a wide variety of tasks from managing basic office services to handling of the most

modern techniques of systems integration, automation, operations research and communication.

In performing these tasks he assumes the position of a full-fledged functional executive at par

with other operational executives.

1.5.1 QUALIFICATIONS OF OFFICE MANAGER:

(i) Education and Practical training,

(ii) Experience and

(iii) Personal qualities.

(i) Education and Practical training: An office manager must have appropriate

educational qualifications. He should possess not only bachelor‘s degree in the relevant

discipline, but also have proficiency in English and one or more foreign languages. The office

manager must also have special training in business administration, accounting, office systems

and procedures, office machines and data processing methods.

(ii) Experience: He should have sufficient business experience preferably be in a similar

organization as the one employing him as office manager. This will enable the office manager

to get familiar with the routine procedures of the organization and also the problems of the

office that he has to manage.

(iii) Personal Qualities: The main task of the office manager is to get the office work done

by personnel of the office efficiently and economically. To achieve this objective he must be

able to organize, inspire and lead the staff under him. He must also try to understand the ability

and aptitude of each individual worker and delegate work to them accordingly. For this he must

possess a number of personal qualities such as leadership, sound judgment, sense of justice and

fair play, impartiality, sincerity, understanding of human nature, tact, persuasiveness etc.

1.5.2 FUNCTIONS OF OFFICE MANAGER

1.

Managerial Functions

2.

Supervisory Functions

3.

Personnel Functions

4.

Duties to the Management.

7

1. Managerial Functions: The office manager is the administrative head of office. It is his duty

to manage the entire affairs of an office. As an administrative incharge, he is expected to

perform the following functions.

Planning the work to be performed before hand.

Forecasting the future demands based on past records.

Organising the activities of office.

Co-ordinating the activities of various departments.

Executing the policies and programmes of the management.

Communicating various policy decisions to the functional managers.

Designing and implementing new systems and procedures.

Reviewing system and procedures periodically and effecting changes in them.

2. Supervisory Functions: The prime duty of office manager is to extract the work from

subordinates. In this regard, he performs the following supervisory functions:

Dividing and allocating the work among the subordinates based on their

specialisations.

Ensuring that the work is carried out as per predetermined schedule.

Exercising regular control over the quantity and quality of the work done by the

subordinates. d. Ensuring the punctuality.

Providing adequate stationery and supplies and controlling their usage.

Arranging for appropriate equipment and maintaining them in proper working

conditions.

Maintain the office, well organised, clean and tidy.

3. Personnel Functions: At times office manager acts as a human relation officer for his own

department. To ensure higher degree of accuracy and efficiency at work he should have efficient

subordinates. For that purpose he discharges the following duties.

Recruit or hire skilled workers for the departments.

Arranging for training and development programmes for the subordinates to upgrade

their knowledge.

Conducting staff appraisal interviews periodically.

Measuring the work of subordinates through appropriate methods.

Fixing up remuneration for the staffs and devising methods for suitable compensation.

Dealing with matters as regards to indiscipline.

Counselling and settling the disputes among the subordinates to the possible extent.

8

4. Duties to the Management: manager is a functional head of the department. He acts as staff

expert to top management and offers advices on various policy matters relating to office routine.

He also performs the functions like

Provision of information that is needed to make policy decisions.

Supporting and implementing the policies of the top management.

Reporting the problems to the management which are beyond his limits.

Identifying problems in the implementation of the policies and reporting to the top

management for remedial action.

Handling mails and fixing up appointments on behalf of top managers.

1.5.3 QUALITIES OF GOOD OFFICE MANAGER:

In the recent years the authority and responsibilities of office manager have grown substantially.

They are more involved in policy decisions. The office manager should be capable to face

challenges of modern complexities of business world. Dynamic office manager possess the

following qualities.

1. Organising Ability: A modern office manager must be a good organiser. He should

organize the office services in such a way that it can be performed smoothly, efficiently and

economically. He has to act in the following manner:

2. Dynamic Leadership: He should be an energetic leader. He should inspire and build

confidence in the minds of the subordinates. He must also encourage the subordinates to

perform their job effectively and efficiently to achieve the common goals of an organisation.

3. Innovative: He should be innovative. He should have creative thinking and capability to

develop better methods and systems. Moreover, he should always in search of new and

innovative methods and techniques of doing the office work in order to increase the efficiency

and quality of the work.

4. Ability to Delegate: Office manager should be competent to divide and allocate the job

among the subordinates according to their capabilities. Effective delegation of authority ensures

accountability among subordinates and indirectly boosts their moral to a higher level.

5. Development of Personnel: He should be a demographic leader. He must encourage the

subordinates to carry on their routine work without his interventions and also allow them to

participate in the decisions relating to their work. He must conduct staff appraisal periodically to

identify their progress and accordingly arrange for training and development programmes for

their self-up gradation.

6. Forward Looking: The office manager should be forward looking. He should be competent

9

to forecast the future, visualize the future problems and devise plan to avoid such problems. E.g.

heavy competition, fall of demand, price hikes etc.,

7. Other Qualities: In addition to the above mentioned qualities, the office manager must have

highest level of integrity and should be honest and ethical in his dealings with everyone both

inside and outside the organisation. He should be freely contacted and consulted by people from

all the departments in the organisation. He should be able to handle situations diplomatically.

1.6 RECORDS MANAGEMENT

The very existence of business organizations, government and other social institutions is based on

records. Keeping good records is very important to any business. Record keeping system should be

accurate, reliable, easy to follow, consistent as to the basis used and be very simple. Good record

keeping is vital in regards to meeting the financial commitments of the business and providing

information on which decisions for the future of the business can be based.

While business maintains the records to monitor and to record normal business activities, it is also

necessary because of obligations under the taxation laws. These records are official documents and

also serve as legal evidence in case of emergencies.

In day to day business operation many documents are received, sent out and created. These

documents play a very important role in business operation and for taking some decisions. So such

documents should be preserved to obtain at the time of need. For that a filing system is developed

in every organization. Filing is the memory of any organization. Hence, filing is the process of

systematic and scientific preservation of official document for future reference or evidence. It is

putting the documents, letters etc into a file. It is a scientific and systematic process of saving

important documents for future reference.

Definition

It is that area of office administration which is concerned with creation, presentation, and use and

disposal of records. According to Jane K Cruible ―Records management refers to the activities

designed to control the lifecycle of a record from its creation to its ultimate disposition.

The functions of records management under these stages are discussed below.

1. Creation of Records: New forms and records should be developed carefully . Data should be

recorded in the documents accurately and completely.

2. Storage of Records: The storage is concerned with the classification of records and then filing in

the suitable filing equipment which is in the easily accessible location. Arrangement should also be

made to protect the records against disaster or unauthorized use.

10

3. Retrieval of record: The records are store for further use. An efficient procedure must be

established so that records may be retrieved and delivered in time.

4. Disposal of records: The last stage in the record cycle is the disposal stage which

is concerned with preserving valuable documents and disposing the expired documents. A record

retention schedule classifies records based on the time period and the requirement of the same.

1.6.1 OBJECTIVES OF RECORD MANAGEMENT:

1. To keep an Orderly Account of Progress: The purpose of writing down and

preserving memoranda of transactions, (financial and other kinds) various documents, papers,

correspondent etc, are to record the progress of the business.

2. To Facilitate Comparison: Records facilitate comparison between one period of time and

another, between different product lines and between firms operating in different lines of business.

3. To Detect Errors and Wastes: Records management is a control function which facilitates the

evolution of techniques for the elimination of errors and waste.

4. Legal Formalities: Certain records are to be kept for a specified period of time under the

provisions of the various Acts. For instance, receipts and payment vouchers and accounts books

have to be kept for several years under the Income Tax Act and so on.

1.7 FILING

Filing is the process of organising the correspondence and records in a proper sequence so

that they can be easily located. The term filing may be defined as the process of so arranging and

storing original records or copies of them, that they can be readily located when required. It

involves placing of documents and papers in acceptable containers according to some

predetermined arrangement so that any of them when required may be located quickly and

conveniently.

Definition

According to Zane K. Quible, ―Filing is one of the activities in the records management

programme which involves systematically classifying, coding, arranging and placing of records in

storage‖. G.R Terry has defined filing as ―the placing of documents and papers in acceptable

containers according to some predetermined arrangement so that any of these may be located

quickly and conveniently, when required‖.

1.7.1 Objectives

The major objectives of filing process are to ensure proper arrangement, careful storing and easy

availability of records. An efficient filing system is expected to have the following objectives:

i) To classify and arrange records properly.

11

ii) To protect documents against possible loss or damage.

iii) To provide a method of obtaining information without loss of time.

iv) To enable past records to be made easily available to management for framing business

policies and future plans.

1.7.2 Functions Of Filing System

Classification of documents on a pre-determined basis.

filing of letters and other documents after action taken in cardboard file covers or folders.

Preservation of file covers or folders in cabinets fitted with drawers.

Issue of files on requisition by any department.

Transfer of papers no longer in current use from the existing files to separate folder or

box files at regular intervals for possible future use.

Disposal of old papers and records when these are no longer useful.

1.7.3 Advantages Of Filing System

Records are stored under a suitable system of filing in order to achieve the following purposes and

benefits.

1. Ready Reference:

Records constitute the storehouse of information relating to past events. They can be referred

conveniently if they are filed in a systematic manner and a proper index is maintained for various

files.

2. Safety of Records:

Filing ensures the safe storage of records of different types. Letters and other documents are put

into folders and the folders are kept in cabinets. Thus records are saved from unforeseen

happenings like theft fine etc.

3. Documentary Proof:

Records serve as documentary evidence in case of disputes. Copies of records can be produced to

settle the claims with different parties. Records can also be produced in a court of law as evidence

when a party to the dispute resorts to the process.

4. Prompt Handling of Correspondence:

Filing enables the handling of correspondence properly without any delay. It builds up the

reputation of the organization and helps in securing orders.

5. Statutory Requirements:

Records are kept in compliance with provisions of various statutes like companies Act, Income tax

Act, Factories Act, etc

12

6. Barometer of Progress:

Filing makes available the records of previous years. It helps in comparing the current year‘s

performance with the previous years. Thus it is an important aid in measuring the efficiency of the

enterprise and various departments.

7. Decision Making and Policy Formulation:

Availability of up-to-date information is essential for taking important decisions and for

formulating policies.

8. Increased Efficiency:

Filing increased the efficiency of the office. It makes available to the management the required

information with speed and accuracy which is helpful for prompt decision-making. Follow-Up

actions are also taken quickly if records of the past correspondence are easily available.

1.7.4 Characteristics of a Good Filing System

1.

Simplicity: The system should be simple so that the employees concerned may operate it

without any difficulty.

2.

Accessibility: The system should enable files to be easily located and papers to be

inserted in files without disturbing the arrangement.

3.

Compactness: The filing section should occupy reasonable space in view of the cost

implication of large space.

4.

Economy: The cost of installation and operation of the system should be proportionate

to the benefits derived from it.

5.

Flexibility: The system should be capable of expansion as the activities of the

organisation expand.

6.

Safety: The records should be safe and available whenever they are needed. There

should not be any danger regarding insects, rain and mishandling.

7.

Retention: There should be a well-defined policy of retaining or discarding the papers

and records. Dead material must be discarded periodically.

8.

Classification: Most suitable method of classification should be adopted. Too many

miscellaneous files and bulky files must be avoided.

1.7.5 Centralized Vs Decentralized Filing

The document and records concerning a particular department of the business enterprise

can be filed either at the department itself or in any other central place. Thus, a business

enterprise can have either a decentralized or centralized filing system. Each system has its own

merits and demerits.

13

Centralized filing system is one where all the filing equipment and personnel are located in a

single section. In other words, under centralized system, all the records of the business firm

(relating to activities of all the sections or departments) are filed in one place or in the central

office. This place is usually called as filing section. This system implies that individual

departments have nothing to do with the filing of records.

Decentralized or Departmental Filing: Under Decentralized filing system, filing is done in

each individual department independently. In other words, each department makes its own

arrangements for filing, install separate equipment and the department staff themselves will look

after this work. Therefore, filing equipment are installed in each and every department. Hence, it

is also known as department filing.

Table Showing Difference between Centralized and Decentralized Filing

Merits of Centralized Filing

Merits of Decentralized Filing

1. There is no duplication of filing equipment

and work

1. Saves time in filing and obtaining . records

when departments are not located nearby.

2. Better utilization of storage space is possible

2. Departmental secrecy can be maintained.

3. There is saving in the cost of records

management

3. Specialized knowledge of staff about the

department prevent errors in filing.

4. Ensures uniformity and standardization of

filing operations. Hence greater efficiency

4. There is flexibility as regards time of using

and returning records

5.Trained personnel with specialization lead to

increased efficiency

5. Ensures prompt availability of records.

6.There is better supervision and control by

expert supervisors.

6. This is not possible

Demerits of Centralized Filing

Demerits of Decentralized Filing

1.Lack of specialized departmental knowledge

of the operating staff

1. Duplication leads to increased cost of

equipment and records.

2. There may be great delay in records being

made available to departments when they are

not located nearby

2. Lack of specialization of personnel in filing

work.

3.Strict rules regarding use and return of files

may cause inconvenience to departments.

3.Standardisation and uniformity filing work is

not possible when each department is free to

adopt its own system of filing.

14

4. It may be difficult to operate a centralized

filing system if records are frequently needed

by many departments.

4. Expert supervision is lacking.

5. It is difficult to maintain secrecy.

5. Confusion may arise in filing documents

concerning more than one department.

1.7.6 Methods Of Filing

(A) Old Methods of filing : There are old filing methods like spike or wire file, folder file,

pigeon hole file, box file, guard book file, expanding case file, and arch leaver file.

1. Spike or Piller and Post File: A thick steel wire with one sharp end and a wooden, plastic or

steel round at the other end is used for filing. It is placed on a desk or is hanged on a nail fixed

on the wall after filing is done.

2 Folder File : There are covers of card board or thick paper fitted with metal hinges for

fastening the papers together. A separate folder is allotted to each customer. All the letters

relating to that customer are kept in the file date wise. The papers are punched and then inserted.

The papers lie flat one above the other. These folders are placed horizontally in drawers.

3.

Pigeon Hole File: It is a special almirah or cupboard divided into number of small

compartments. It is open from one side and the compartments are square holes called ‗pigeon

holes‘. Each pigeon hole bears a letter of the alphabet. When letters are received they are sorted

according to the alphabet or subject wise. For example the letter received form Tushar & Co. is

inserted into the hole marked with ‗T‘. Brief particulars are also recorded on each letter. This

recording is known as docketing. This method is used in post office for sorting letters.

4.

Box File: Box file, as the name suggests, is made in the shape of boxes. Quite often papers

are first put into folders and then they are placed in box file. It helps to preserve papers better as

they are safe and gather less dirt.For classification purposes, papers relating to different subjects

can be folded. This method is useful for travelling agents and where correspondence is stored

temporarily.

5.

Guard Book File: Under this method, the paper or vouchers are pasted in bound book

datewise. This method is often used for recording minutes and preserving receipts and vouchers.

It avoids the possibility of loss or misplacement of any paper.

6.

Expanding Case File: Under this method, the papers are usually placed alphabetically in

numbered or lettered pockets of cases. This equipment is useful for filing papers in transit.

15

These cases or pockets can be useful for keeping papers together for temporary purchases.

These cases can expand as per the need.

7.

Arch Lever File: These are strong card board folders containing strong metal arches. These

arches can be operated by a lever. When a paper is to be filed, it is punched with two holes with

punching machine. The lever is then moved upward which opens up the metal arches or springs.

After paper is inserted through the holes the lever is pressed down to close the spring. The

papers in the file lie flat one upon the other.

(B) Modern methods of Filing

Old methods described above have limited use and are suitable only for small concerns. Even

then these are being replaced by modern methods. The modern methods of filing used in offices,

big or small, may be classified into two categories:

i) Horizontal Filing

ii) ii) Vertical Filing

Horizontal Filing: In this system papers are kept in file covers or folders one upon the other in

horizontal position. The papers are kept in chronological order inside cardboard file covers. The

papers are held together by metal hinges or levers. The files are then kept in cupboards in a

horizontal position one above the other. When any paper is required, the relevant file is taken

out and after use it is put back in the same position.

The advantages of horizontal filing are:

This method is simple to understand, easy to operate and economical to maintain.

Letters can be referred to in a file without removing them from it.

As letters are chronologically arranged, it becomes very easy to locate them.

Files are well protected from dust and moisture using thick covers and cupboards

Some of the disadvantages are:

It is not very flexible.

It is difficult to remove papers from files lying at the bottom or middle of the heap.

This system cannot be profitably used by large offices.

The equipments used are more space consuming.

Vertical Filing : This is the most modern method of filing. In this method papers are placed in

files and kept in an upright, standing position. The folders are stored in specially designed

cabinets. The front side of the folder is slightly shorter. The extended part of the back is used to

indicate the code number of the file. The drawers of the steel cabinet are deep enough to hold the

folders in vertical position. In order to divide the drawer into convenient sections guide cards are

16

placed at appropriate places. Under this method a separate folder is provided for each customer or

subject. The folders may be arranged alphabetically, numberically, geographically or subject-wise.

This system has become very popular in large offices and big business houses.

Advantages of vertical filing are :

It is a flexible system .

It is adaptable to various systems of classification.

The location of papers is possible without much difficulty and loss of time.

It takes less time to file papers in folders.

It provides proper safety of papers and documents.

Disadvantages of vertical filing are :

The equipment used like steel cabinets etc. is more costly.

It is not suitable for small offices.

Folders may slip down the drawers and get misplaced.

1.8 CLASSIFICATION OF FILES

Classification can be defined as the process of selecting headings under which documents are

grouped or classified on the basis of certain common characteristics before filing takes place. The

principal object of classification of files is to ensure prompt availability of information whenever it

is needed. Classification aids the filing functions to attain these principal objects.The efficiency,

particularly, the accessibility of a filing system depends largely upon the care with which

documents are classified. By classifying similar paper or papers belonging to a particular head or

subject, office staff are able to trace out the paper or documents required at any time with minimum

delay and trouble

1. Alphabetical Classification

2. Numerical Classification

3. Geographical Classification

4. Subject Classification and

5. Chronological Classification.

1. Alphabetical Classification:

Alphabetical classification is based on the occurrence of the letters in the alphabet as it is done for

the dictionary. Under the alphabetical classification, the filing of papers and documents is either by

17

the names of the correspondents or the subjects. This method of classification can be used in

correspondence filing, contracts, orders and staff records.

2. Numerical Classification

Under this method, each folder or record is given a number and the files are arranged in the

numerical order i.e. each customer or subject is allotted a number. All papers relating to a particular

customer or supplier or subject are placed in one folder bearing its distinctive number.

Folders are arranged in the cabinet numerical sequence and guide cards are used to divide them into

suitable groups of 10 or 20. Thus, if a customer, is allotted the number 14, all papers and documents

connected with him will be found in folder number 14..

3. Geographical Classification

Under this system, files are arranged according to the location or addresses of the persons or parties

to whom they relate. The classification can be street-wise, town-wise, district-wise, state-wise or

country-wise. This system will operate efficiently only when it is combined with either numerical

system or alphabetical system. This system of classification is generally followed in organizations

engaged in export trade or doing business over a wide geographical area. Mail order houses, banks,

insurance companies etc. also adopt this system of classification. This system is also suitable in

those concerns where records are required according to the sales territory.

4. Subject Classification:

Under this system, all documents concerned with a particular subject are brought together in one

file. Such document may have come from different sources and from different people. This system

is adopted only when the subject or content of a letter is more important than the name of the

correspondent. Each subject matter is kept in a separate file. These files may then be arranged

alphabetically, numerically or on some other basis. For instance, separate files may be maintained

for purchase quotations, purchase orders, income tax returns, traveling allowance bills and so on.

5. Chronological Classification

Under this method various records are identified and arranged in strict date order and sometimes

even according to the time of the day. It is a useful method for filing invoices and other vouchers

associated with accounts.This system may be useful if used along with some other system. The

records may be arranged alphabetically first and then can be arranged date-wise within each folder.

So this system cannot be used independently.

18

1.9 INDEXING

Indexing is an important aid to filing. Filing and indexing are so interrelated that filing without

indexing is incomplete and indexing without filing does not exist. Indexing means an arranged

system through which the required documents and papers are easily located for the speedy

disposal of urgent and/or ordinary matters.

Indexing is the process of determining the name, subject or other captions under which the

documents are filed. Index is a guide to records. The main purpose of an index is to facilitate the

location of required files and papers. Index helps the staff to find out whether a particular file

exists for a party or subject, and its place in the container. It also facilitates cross referencing.

Where records are classified in numerical order, or subject wise an index is necessary.

1.9.1 Purpose Of Indexing

Easy location of files and documents

Speedy cross-referencing

Saving of time and effort in locating records

Efficiency of record keeping

Reducing the operating cost of records management

1.9.2 Essentials Of A Good Indexing System

1. Simplicity: An indexing system should be simple to understand and operate. It should not

involve unnecessary complex in operation.

2. Economy: It should be economical in terms of money, space, and effort. The purchase of

indexing equipment requires heavy investment during initial period. Therefore, proper attention

should be devoted to ensure economical use in the end.

3. Flexibility: The selected index system should have sufficient scope for expansion. A single

system may be used for several purposes.

4. Efficiency: Any index system should ensure speed in operation and requires minimum time for

operation.

5. Safety: The index system should protect the records against dust, fire, water, rats, insects, water

etc. The safety should be equipped with lock facility to prevent pilferage of records.

6. Conformity with Filing System: The selection of index method depends upon the nature and

type of filing system adopted in an organization. Hence, there must be a correlation between the

19

filing system and index method.

7. Cross Reference: There should be Cross reference under the head under which a document

could be filed but has not been filed.

8. Signaling: A tab or slip should be attached at the edge of the card or file. The tab or slip

contains facts of the document briefly. This is used to draw the attention of the needy persons of

files.

19.3 Types Of Indexes

The main types of indexes are:

1.

Ordinary Page Index

a)

Bound book index

b)

Loose leaf index

c)

Vowel index

2.

Vertical Card Index

3.

Visible Card Index

4.

Strip Index

5.

Wheel or Rotary Index

1.

Ordinary Page Index: It is similar to the subject index given at the end of standard

books in which the subject matter is alphabetically arranged and then relevant page numbers

are given against each heading or sub-heading. Some times it consists of specially designed

pages fitted with a tab indicating an alphabet and on each page the names or subjects starting

with that alphabet are written along with the page numbers. This type of index can be (a)

Bound Book index, (b) Loose Leaf index, or (c) Vowel Index.

(a)

Bound Book Index: Under this system, index is prepared in a bound book or register

divided into alphabetical sections in which the names or documents are entered. Each section

has the leaves cut away at the right hand side so that the initial letters of all the sections are

visible at a glance. All entries relating to a letter or alphabet are arranged in the same section or

page reserved for it.

The merits of this method are:

It is a very simple method of indexing;

No special training is required of the staff;

It is very economical as it does not need costly equipment.

20

It is compact and handy and can be used for a long period;

It is popular in small organizations.

The main drawbacks are :

It is not flexible and cannot be expanded beyond a limit;

Alteration is not possible if anything has been wrongly entered.

Dead subjects cannot be deleted;

The location of names is difficult as they are not entered in alphabetical sequence;

It is suitable for small offices only.

(b)

Loose-Leaf Index: This is an improved version of the bound book index. The bound book

becomes inconvenient to handle if it is too big. In loose leaf index single sheets are punched to

fit in between metal hinges with the help of a metal screw. Pages are loose so that any page can

be taken out or additional pages inserted. To insert or remove the pages the metal hinges have to

be unscrewed. The binder with the loose index sheets can be locked so that no one can take out

any sheet without having authority to do so.

The main advantages of loose-leaf index are :

This method provides for maximum flexibility and can be adapted to suit the needs.

It is convenient to handle and provides quick and easy reference.

Dead records can be withdrawn and stored at the back. (iv) It is more economical than

other methods of indexing.

The sheets can be used for many different purposes such as keeping additional

information regarding a customer e.g. credit rating, telephone number, postal and

telegraphic addresses etc.

The main drawbacks are:

It takes longer to locate a particular index page.

Through constant handling the sheet may be damaged.

There is a possibility of the sheets being misplaced after they have been taken out.

If pages are used for multiple purposes, there are chances of committing errors.

(c)

Vowel Index: It is a modification of the book index. In big organisations which deal with

large correspondence, the index book is maintained on the basis of vowel classification in

order to facilitate quick reference. The section of book reserved for an alphabet is subdivided

21

into subsections, each of which is reserved for a vowel, that is, a,e,i,o,u and y. The page is first

selected by the initial letter and then by the vowel occurring after the initial letter, For

example, the name ‗Gandhi‘ will be recorded in the section reserved for ‗G‘ and in the vowel

sub-section ‗a‘. The system is simple, easy to operate, economical, and suitable for large

organisations. but it is not suitable for small offices.

2. Vertical Card Index Under this system each subject, customer or document is allotted a

separate card on which necessary information appears. The cards may be of small size (12.5

cms x 7.5 cms) or as per need. They are classified and arranged alphabetically, numerically,

geographically or subjectwise. The alphabetical classification is more popular. In some cases

more than one card may be prepared for the same set of information and each card may be

arranged in different manner e.g. in library usually two cards are prepared for each book — one

is arranged on the basis of author and the other on the basis of title of the book. The cards are

filed vertically in steel or wooden drawers. A hole is punched into each card to keep the card in

its proper place. Guide Cards may be used to indicate groups of cards in a class. This type of

index is very popular in big offices.

Advantages. (i) It provides for flexibility as the number of cards can be increased or decreased

without disturbing the arrangement. (ii) It is economical to operate (iii) It is simple and easy to

understand. (iv) The system can be used for many different purposes. (v) Dead records can be

withdrawn at any time. (vi) It can be used by several persons at the same time. (vii) Cards can

be arranged in any order.

Limitations. (i) All the cards are not visible at a glance. (ii) Cards may get lost or damaged

since removal of cards is easy. (iii) Cards may get torn due to constant handling. (iv) The

equipment is costly. (v) A regular check is required to ensure that cards removed for reference

are replaced in their proper places.

3. Visible Card Index

The cards are arranged flat in a shallow tray or metal frame. Each card is attached to metal

hinge and overlaps the one before it, so that name address and other particulars are visible

without touching other cards. The frames or trays are attached vertically to the metal stands or

they can be put horizontally into cabinets. The details of data can be written or typed on the

front or back of the cards for reference.

22

Advantages : (i) It occupies less space. (ii) The reference is much faster. Cards are easily

located. (iii) any information can be added without disturbing the arrangement. (iv) Out dated

cards can be removed easily whenever necessary. (v) Its capacity is quite large. More cards can

be accommodated in the same space. (vi) It is widely used in libraries, banks, insurance

companies and other organisations.

Disadvantages. (i) It requires costly equipment. (ii) Designing and operating the system needs

Commerce (Business Studies) training. (iii) Making entries on cards takes more time.

4. Strip Index:

In every office there is need for a list of names of parties to be maintained with their telephone

numbers, addresses etc. A line entry on a narrow strip of card board can be prepared for a single

item. These strips are arranged in a frame in such a way that they can be taken out and replaced

with ease. Frames can be hanged on the wall or put on the table in a book form or even arranged

on a rotary stand which can be turned round to look at any part of the index.

5. Wheel or Rotary Index:

Under this method cards are arranged around the hub of a wheel which may be portable. A

single wheel can hold as many as 5000 cards. A card can be inserted or withdrawn without

disturbing the other cards. Entries can also be made on the cards without removing from the

wheel. The merits of this system are quick and easy referencing, economy of time and efforts,

economy of space, elasticity, etc.

1.10 FILING EQUIPMENT

Individuals and businesses have a variety of choices when it comes to filing equipment. Some

options offer high levels of security while others can accommodate a high density of files. The

amount of space you have, the sensitivity of the files and your preference for physical or

electronic records all influence your choice of filing equipment.

1.10.1 Purpose Of Selecting Filing Equipment

The following purposes must to keep in mind while selecting the filing equipment.

1. It protects the document against careless handling.

2. It prevents theft or unauthorized references.

3. It protects the documents against deterioration through dust.

4. It reduces the physical efforts in inserting, locating and extracting documents.

23

5. It protects the documents against the loss made by fire.

1.10.3 Factors Affecting The Selection Of Filing Equipment

The following factors are affecting while selecting anyone of the filing equipment.

1. The number and the size of records to be maintained.

2. The frequency of reference of files.

3. The speed with which the documents is required.

4. The physical appearance of the equipment as a piece of furniture.

5. The life of filing equipment and the duration required for maintenance.

1.10.2 Requirements Of Good Filing Equipment

1. Adequacy: The filing equipment should be fully adequate for the purpose for which it is to be

used. If not so, the labour of filing and expends will be increased.

2. Simplicity: The filing equipment should be simple with adequate indexes, guides and folders.

3. Less effort: The use of filing equipment should require less effort.

4. Quality: The duration of the filing equipment should not be less than 20 years. The frequent

changing of filing equipment may dislocate the documents and increase the expenses.

5. Economy in Space: The filing equipment should be economical in its use of space.

1.10.4Types Of Filing Equipment’s

Physical Filing Equipment

Filing Cabinets : Four drawers allowing files to be stored laterally is standard. These cabinets

keep records secure as these cabinets can be locked, a company can limit access to sensitive

files while still allowing employees and visitors to enter the room. Out of all the physical filing

equipment options, cabinets tend to be the most expensive and have the most limited capacity.

Open Shelving

An alternative to filing cabinets is open shelving. Units are similar to open bookcases and are

specifically designed for folder height and width. The design allows users easy access to files

and can be either stationary or be mobile if rollers are attached to the bottom. Open shelving

saves on space and money. Shelf filing equipment typically is three times less expensive than

filing cabinets. Compared to a four-drawer filing cabinet, a seven-tier open shelving system has

24

80 percent more capacity.

Digital Filing Equipment

Individuals and businesses that want to take advantage of technology can store files digitally

rather than physically. Electronic documents are saved directly into the system, and physical

documents can be scanned and converted into a digital format. Digital filing systems allow users

to search information quickly and keep data secure. As with physical filing, users have a choice

of systems and equipment for a digital system. Files can be organized and stored locally on a

laptop's or PC's internal hard drive.

External Devices

It's convenient to use a computer's internal hard drive to store files, but you risk losing your

information if the hard drive is corrupted or physically damaged. To mitigate this risk, users

may want to back up data to an external device. PC World recommends backing up critical files

to an external hard drive and using a thumb drive to transfer files as needed.

Servers

Businesses that want multiple parties to have access to the same data may want to invest in a

server. Servers act as a central repository for many users' files. PC World notes that businesses

can host multiuser applications like databases and enterprise resource planning systems on the

server. This makes it easy for a large number of individuals to have access to the same files.

Server data can be backed up to an external device or the cloud for extra security. Physical

servers look similar to a high-end PC. Alternatively, businesses can choose a cloud-based

hosting service Amazon Web Services, Windows Azure and Rack space Cloud Services are all

options which doesn't require a physical server filing cabinet that takes up a 6-foot-by 24-foot

filing area can hold approximately 8,448 folders.

1. 10.5 Steps in Installing Or Planning The Filing System

1. Preparation of List of Documents: A list of all documents and papers to be filed is prepared. The

list is prepared according to the needs and policy of the concerned business organization. Generally,

the list contains the documents to be filed which are required in future reference.

2. Decide Period of Storage: The period of storage of documents should be decided by the top

management after consulting all the departmental heads.

25

3. Decide Storage Space and Acquire: The need of storage space is decided by the office manager.

Keeping in view of volume of documents to be filed, adequate funds may be allocated to acquire

needed storage space.

4. Filling Department Layout: The layout of the filing is prepared in such a way that the documents

are accessible in an easily manner. The storage arrangement should be decided on the basis of the

frequency use of the documents.

5. Deciding Filing Equipment: Various types of filing equipment can be procured to preserve

different kinds of documents. The nature and importance of documents are taken into account to

select filing equipment. Fireproof filing equipment should be purchased to preserve valuable

documents and confidential records. The routine types of records are preserved in an open shelf.

6. Determining System of Classification: A suitable system should be selected for the classification

of records.

7. Protection of Records: Proper arrangements should be made in order to protect the records form

loss or damage.

8. Training of Staff: Adequate training should be imparted to office staff for handling various filing

operations. There must be a clear definition of duties and responsibilities of staff members of filing

department.

9. Issuing Procedure: No admission without permission principle is followed to enter into the filing

department. Besides, the files should be issued only to the authorized persons. A separate register is

maintained to record the issues and receipts of all files.

QUESTIONS

PART A

1. Define ‗Office‘.

2. List out the Basic Office Function.

3. Classify various types of offices.

4. Demonstrate the qualifications required for an office manager.

5. State the qualities of a good office manager.

6. Bring out the difference between traditional office and modern office.

7. Enumerate the advantages of filing system.

8. Differentiate horizontal filing and vertical filing.

9. Mention the purpose of indexing.

26

10. Determine factors affecting the selection of filing equipment

PART B

11. Describe the importance of office to an organisation

12. Elaborate the functions of modern office.

13. Discuss in detail about the functions of office manager.

14. Explain in detail the various functions and objectives of record management.

15. Describe the essentials of a good filing system.

16. Differentiate Centralized and decentralized filing system

17. Classify the various types of filing equipment.

18. Elucidate various types of classification of files.

References

1. Office organization and Management- By S.P.Arora.

2. Office Management- By P.K. Ghosh

3. Office Management – By Kathiresan &Dr.Radha

SCHOOL OF MANAGEMENT STUDIES

UNIT – II - OFFICE MANAGEMENT– SBAA1407

1

II. MAIL AND MAILING PROCEDURE

2.1 MEANING AND DEFINITION

The term “Mail” in the common parlance refers to written communication. It may be either

received or sent out. A mail received is known as inward mail and a communication sent out is

called as outward mail. Mail may be described as any written communication which passes through

the messenger, courier or the post office. There is need of continuous contacts with the customers,

suppliers, branches, departments, banks, financial institutions, government agencies, non —

government organization, and the like.

George R. Terry rightly remarked that “it is doubtful that a modern office could exist

without mail”. The reason is obvious that every business house has to maintain close contact with

the outside world. It should correspond to its customers, its own branches, departments, and various

other institutions, government etc., the business firm grows; the volume of transactions will also

grow.

2.2 TYPES OF MAIL SERVICE

Business mail is of three distinct types. They are listed below.

1. Incoming or inward mail.

2. Outgoing or outward mail and

3. Inter — departmental mail.

The form of these types of mails are letters, documents. packets, parcels, telegrams, orders,

remittances etc. Prompt and correct handling of mail is necessary for achieving purpose of mail.

Moreover, proper handling of mail increases the goodwill of the business office. The existing

relationship of business office with outsiders is strengthened through efficient operation or handling

of mail service. Thus handling of mail is an important supplement to other office operations, viz.,

making original records, typing and duplicating etc. The mailing service should be planned and

organized properly to ensure prompt and correct handling of mail.

2.3 IMPORTANCE OF MAILING SERVICE

In the modern globalized business world, mail service is an integral part of office work. Hence,

adequate facilities should be provided for efficient and successful performance of mail service. An

efficient mailing service offers the following benefits.

2

1. It ensures continuous contacts with outsiders.

2. A good impression is created in the minds of outsiders and thereby improves the goodwill of the

business.

3. The interdepartmental co-operation is also improved with the help of efficient mail service.

4. It helps the business office in the creation of correspondence and record keeping of all the

departments.

5. It helps to reduce the cost of the mailing service.

6. The new employee of business office gets training very easily and makes them familiar with the

organizational set up, work routine, authority and responsibility, organization structure and the like

of the firm.

2.4 COMPONENTS OF MAIL SERVICE

The following elements are included in the efficient mailing service

1. Adequate facilities are provided for the mail service.

2. Creation and organization of mailing department correctly.

3. Arrangements made with post office.

4. Establishing inward and outward mail procedure.

5. Mechanization of mail service.

6. Supervision of mail service.

2.5 CENTRALIZED CORRESPONDENCE

A separate division or section or department is created for handling correspondence to the entire

organization under centralized correspondence. A separate person is appointed to organize and look

after the work of the correspondence department. The volume of correspondence is very large in

large organization; hence, a separate correspondence department is created and assigned to the

qualified person. He exercises full control on the department. The correspondence department

receives all letters, gathers the necessary information from various departments, drafts, letters and

replies, dictates letters dispatches them and follow up all letters. But at the same time, personal

secretary is dealing the letters of top executives of an organization. A correspondence manual is

prepared by the correspondence department for reference of all the departments

3

Advantages of centralized mailing service

The advantages of a centralized mailing department are :

i. High degree of specialization: It makes certain that specialization in the mailing service

is ensured. Specialization enables precision and rapidly in the work.

ii. Uniformity in standard: It maintains consistency in the standard of quality and approach.

This system ensures standardization of all correspondence made by the business hours.

iii. Better quality of work: It increases efficiency of work in their entails good output. As a

consequence the degree of work become better and the organisation attains a good

reputation.

iv. Better supervision and coordination : A well trained and expert supervision may be

appointed to lead the dispatching department. Better supervision would ensure an ever

and quick performance of mailing operations.

v. Saving time and money: Mailing operations can be methodical under this system. Proper

methods can be set forth and brought into union with mailing operations. This would

make for savings in time and money.

vi. Increase in efficiency: It increases efficiency of employees as they specialize in looking

after the correspondence only.

vii. Keeping away duplication of work: All types of corresponding (inward, outward and

inter department are changed to the central mailing department. As a result duplication of

endeavor is stopped.

viii. Use of modern equipment: The mechanization of the mailing dept, is possible under this

system. Various labor saving devices (folding and sealing machines, fracking machines

can be used in the best way.

2.6 HANDLING OF INCOMING MAIL

In every organization, there are defined steps for physical handling of inward mail so that the mail

could reach the concerned official without delay. These steps vary depending on the size and nature

of the organization. The following procedure is usually followed in handling of incoming mail if

the mail is received manually/physically.

4

1. Receiving Mail

Mail is delivered once or twice a day by a Postman in an organization while mail from special

messengers or courier companies keep pouring throughout the day. A Junior Secretary or Mailing

Clerk is entrusted with the task of receiving the mail and providing acknowledgement of the

receipt, wherever necessary. In case the mail is to be received from Post Box or Post Bag, a person

is deputed to collect the same from the Post Office once or twice a day.

2. Sorting Mail

After receiving the mail, it is necessary to sort the received mail so that mail marked as Private,

Personal, Secret, Confidential etc. are not opened. This type of mail is directly delivered to the

person concerned unopened. Important mail viz. court summons, tenders, confidential reports etc. is

sorted out from the routine mail to accord priority in opening. Routine mail consisting of sales

letters, catalogues, product literature etc. are opened at last. Trays or open racks with separate

compartments are usually available in Mailing Department in which segregated mail is kept while

sorting. Trays or racks used for sorting mail have the name of the departments clearly marked on

them.

3. Opening Mail

A paper knife is generally used for opening envelopes. In case of large mail, a Letter Opening

Machine is helpful as it improves efficiency and opens the mail neatly. While opening an envelope,

it should be ensured that:

a) contents of the envelope are not damaged.

b) before disposing off the envelope, nothing is left inside the envelope.

c) enclosures are fastened if they are not properly tagged.

Sometimes, it is necessary to preserve the envelope received along with the mail. In such cases, the

same is attached along with the letter.

4. Examining Contents and Stamping Mail

After opening the mail, a Secretary should briefly examine its contents. Examining of contents is

done to again sort out the mail which needs immediate action so as to accord priority. Sometimes,

there are certain letters which require time-bound reply and are to be dealt on urgent basis.

Examining of contents of mail also help to know if any of the enclosures of the letter are missing.

In such cases, the facts are recorded on the letter. All the mail received is date-stamped to

5

authenticate receiving of the same in the organization. It can be done with the help of a Rubber

Stamp or an Automatic Numbering & Dating Machine.

5. Recording Mail

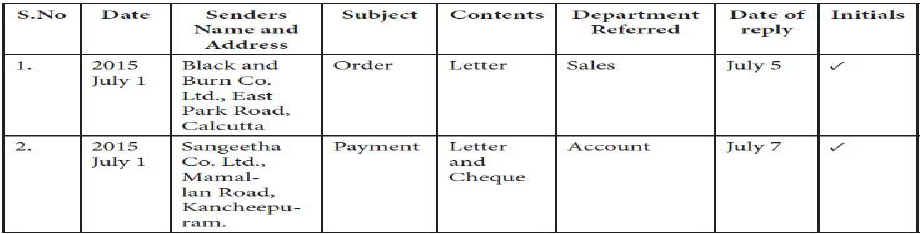

Recording of mail helps in tracing out any received letter at a later date. An Incoming Mail Register

is maintained to make a brief record of all the incoming mail. Incoming Mail Register is also called

Diary Register or Dak Register. An Incoming Mail Register also has a column viz. Date of Reply to

ensure that all the received mail has been attended to.

6. Distributing Mail

The recorded mail is segregated department-wise and immediately distributed to the concerned

departments by a peon or messenger.

7. Follow-up Action

Every incoming mail which needs a follow up action should be quickly attended to by the

concerned official. In business houses, it is ensured that every mail received should be disposed-off

within maximum 3-4 days, wherever possible.

2.7 HANDLING OF OUTGOING MAIL

Like incoming mail, speedy disposal of outward mail is equally important. Delay in sending mail

not only results in loss of business prospects but also creates a bad image for the company. While

on the other hand, quick replies of mail show the importance which has been attached to it. The

following steps are generally followed in case of handling of outward mail physically:

1. Production of Mail

The letters which are sent out of an organization are prepared and signed by an authorized person.

Every outgoing mail should bear a reference number which facilitates future reference of the same.

The mail ready to be dispatched is usually kept in „Out Tray‟ available in all departments.

6

2. Collection of Mail

All outgoing letters are collected twice a day by a peon deputed by Mailing Department for onward

transmission. A Professional Secretary should ensure that the mail is collected timely so that it

could be dispatched from the office without delay. It is also the duty of the Professional Secretary

to mention the preferred mode of dispatch of the mail. The Mailing Department or Despatch

Section delivers the mail according to the instructions given on the mail.

3. Recording Mail

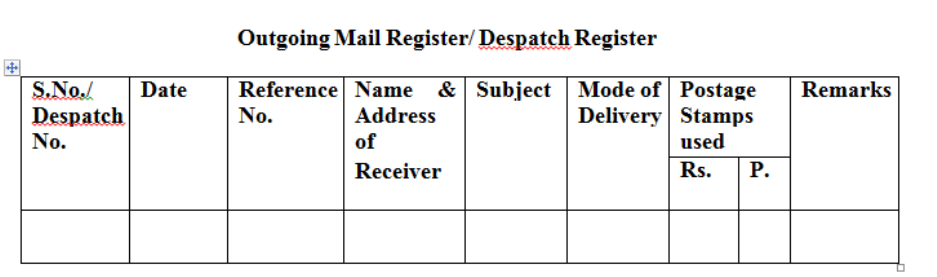

Every outgoing mail is to be recorded in a register called Despatch Register or Mail Outward

Register. A specimen of the same is given below:

4. Writing of Addresses

If the mail is to be sent in an envelope, the same should be selected of suitable size

according to the size and number of paper (s) to be inserted it. While writing address on an

envelope, it is ensured that the address should be written parallel to the length of the cover and in

the lower half and towards the right-hand side thus leaving adequate margin at the top for the

postage stamps and labels, postmarks and other indications.

Writing of correct, legible and complete address of the receiver on the outward mail is very

important point to be taken care of by a Professional Secretary. Use of PIN code, speedy and

accurate postal delivery is possible all over the country. In case of addressing of large mail, an

Addressing Machine can be used which saves a lot of time and energy of a Professional Secretary

besides reproduction of correct address on the outgoing mail?

5. Folding letters and inserting them into Envelopes

Letters intended to be inserted into envelopes should be folded in such a manner that it has

minimum number of folds according to the size of the envelopes. Letters and enclosures must be

7

folded together. Folding and Inserting Machines can be used to make the task easy for a secretary in

case of handling of large outgoing mail.

6. Sealing of Envelopes

The next step is to seal the envelopes to secure the contents of letters. The mail containing financial

documents, registered and insured articles should be sealed carefully. Book Post mail mostly

consisting of Product literatures, catalogues, price lists etc. are sometimes not sealed for the

convenience of the receiver.

7. Affixing Stamps on Envelopes

On the outgoing mail to be sent through Post Office, postage stamps of required denominations are

to be affixed as per the prescribed rates. The mail is weighed to calculate the correct amount of the

postage stamps. Over-stamping and under-stamping are to be avoided at all costs. Franking

Machines are commonly used by offices for stamping the outgoing mail.

8. Posting Mail

Posting of Mail is the last step in the procedure of handling of outgoing mail. Letters intended to be

sent through Post Office are sent by a peon to the nearest Post Office. Mail marked as Registered,

Speed Post, Insured etc. are submitted at the counter of the Post Office and a proof of delivery of

the mail is obtained. Local mail which is to be sent through special messenger is handed over to the

concerned person along with Peon Book. Courier Mail is handed over to the representatives of

courier companies, whenever they arrive as per the specified time schedules.

2.8 HANDLING OF ELECTRONIC MAIL

Electronically, mail can be received or sent out with the help of computer, fax, mobile phone etc via

a network. This type of mail does not have any elaborate handling procedure. The mail is mostly

addressed by name on individual‟s e mail address or number. Fax and e-mail messages on receipt

are directly delivered to person concerned for further action. E-mail means messages distributed

from one computer to one or more recipients with the help of internet. An e-mail message consists

of two parts: the message header and message body. The message header contains space for email

address (s) and subject. The content of the mail is written in the message body. The mail is easy to

compose and transmit just with a click of button. It is generally received and sent from an

individual‟s e-mail address in an organization.

8

E-mail has given rise to concept of Paperless Office because of the following advantages:

• Speedy delivery

• Economy

• Security

• Feasibility of sending bulk mail

• Possibility of use of pictures, demonstrations etc.

• Automated record management

The problems which may be associated with e-mail include threat of virus, hacking of mail,

crowded in-box etc. However, with the various techniques, it is possible to deal and overcome all

these hazards. It is important that in-box of mail should be checked-in regularly. Due to exponential

growth of mail volumes, Digital Mail Rooms are set up now-a-days in organizations. In such Mail

Rooms, documents are scanned, archived and retrieved in original image format. Electronic mail

formats, fax etc. can also be combined while document processing. The setting of Digital Mail

Rooms has reduced decision making cycles, saved paper costs and rationalized circulation of

information.

2.8 MAIL ROOM EQUIPMENT

A mailroom is a room in which often incoming and outgoing mail is processed and sorted.. Various

mechanical equipment is used to handle the incoming and outgoing mail efficiently and effectively.

Use of the mechanical devices also help to reduce monotony and increase accuracy of mailing

operations. Equipment and machines in Mail Room has following advantages:

Increase in the speed of operations.

Saving of time.

Improvement in efficiency and accuracy.

Elimination of wastage.

Simplification of fixing of postage and avoidance of misuse of postage stamps.

The following Mail Room Equipment is commonly used in a large organization:

1. Letter Opening Machine

With the help of a Letter Opening Machine which operates manually or electrically at a great speed

and can open 100 to 500 letters per minute, work of opening of mail can be efficiently managed. It

has a rotary knife which shaves off a very thin slice of the edge of envelopes. While using the

machine, one should be careful that the contents of the envelope are not damaged.

9

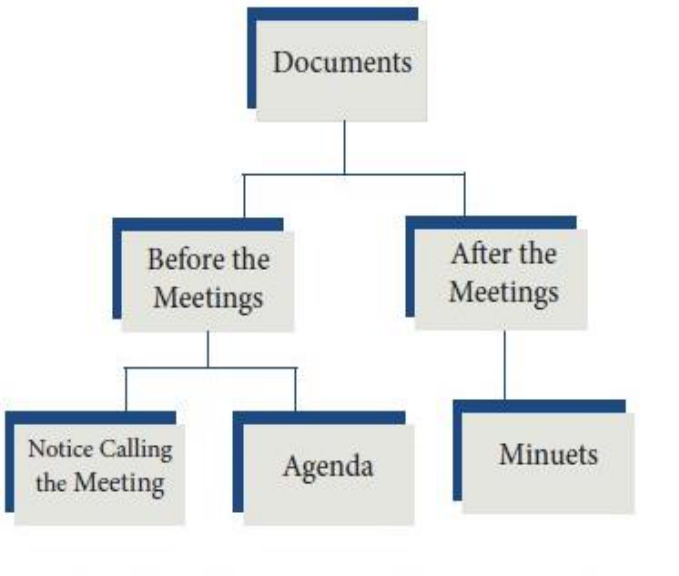

2. Numbering and Dating Machines